Tag Archives : Taxation

Even Officials from the Clinton Administration Agree that the United States Should Have a Lower Corporate Tax Rate

Since the Clinton Administration turned out to be much more market-oriented than either his GOP predecessor or successor, this isn’t quite a man-bites-dog story. Nonetheless, it is still noteworthy that Elaine Kamarck, a high-level official from the Clinton White House, has a column on a left-of-center website arguing in favor of a pro-growth, supply-side corporate […]

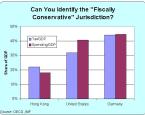

read more...According to the Cluelsss Crowd at the Washington Post, Germany Is “Fiscally Conservative”

By European standards, Germany is in pretty good shape. There’s a very large welfare state and the tax burden is quite onerous, both of which hinder growth, but Germany has been more responsible than the United States in recent years. And while this may be damning with faint praise, this modest bit of fiscal discipline […]

read more...Why Are American Tax Dollars Subsidizing a Paris-Based Bureaucracy so It Can Help the AFL-CIO Push Obama’s Class-Warfare Agenda?

To be blunt, I’m not a big fan of the Organization for Economic Cooperation and Development. But my animosity isn’t because OECD bureaucrats threatened to have me arrested and thrown in a Mexican jail. Instead, I don’t like the Paris-based bureaucracy because it pushes a statist agenda of bigger government. This Center for Freedom and Prosperity […]

read more...In Defense of “Trickle-Down” Economics

Back in September, I posted a flowchart showing how the current tax system is biased against saving and investment. Simply stated, the federal government largely leaves you unmolested if you consume your after-tax income, but there are as many as four extra layers of tax on income that is saved and invested (a point I […]

read more...The Less-than-Thrilled Case for Extending the Payroll Tax Holiday

When I think about taxes, my first instinct is to rip up the corrupt internal revenue code and implement a simple and fair flat tax. When I think about Social Security, my first instinct is to copy dozens of other nations and implement personal retirement accounts. Unfortunately, the political system rarely generates opportunities to enact […]

read more...Some “Conservative” Members of the Stupid Party Push for Tax Increases to Enable Bigger Government

What would you do if you saw somebody standing at the top of a skyscraper, about to jump? Would you avert your eyes in horror? Would you watch in dismay as they plummeted to the ground? These are similar to the thoughts that are going through my mind as I watch Republicans begin the process […]

read more...Alan Blinder’s Accidental Case for the Flat Tax

Alan Blinder has a distinguished resume. He’s a professor at Princeton and he served as Vice Chairman of the Federal Reserve. So I was interested to see he authored an attack on the flat tax – and I was happy after I read his column. Why? Well, because his arguments are rather weak. So anemic […]

read more...The Tobin Tax on Financial Transactions Would Be Bad for Investment, Bad for Competitiveness

I’m periodically asked about proposals to impose “small” taxes on transactions. There are a couple of versions of this idea. In some cases, such proposals are designed to tax every economic transaction and supposedly generate enough money to replace all other taxes. In recent years, though, I’m usually asked about levying a “Tobin Tax,” which […]

read more...Per Dollar Spent, OECD Subsidies May Be the Most Destructively Wasteful Part of the Federal Budget

I’m not a fan of international bureaucracies. I’ve criticized the United Nations for wanting global taxes. I’ve condemned the International Monetary Fund for promoting bigger government. I’ve even excoriated the largely unknown Basel Committee on Banking Supervision for misguided regulations that contributed to the financial crisis. But the worse international bureaucracy, at least when measured […]

read more...Will the Stupid Party Agree to Higher Taxes and More Wasteful Spending?

I’m baffled by stupid Republicans (sorry to be redundant). Some GOPers have agreed to put taxes on the table. Not surprisingly, Democrats are praising them for this preemptive surrender, patting these Republicans on the head for being good little lapdogs. (The Democrats are also high-fiving each other since they openly admit that tricking Republicans into […]

read more...