Tag Archives : Taxation

The 2001 and 2003 Tax Cuts Should Not Be Allowed to Expire

Simon Johnson is a professor at MIT and a former IMF official. With that kind of resume, you won’t be surprised to learn that he is much too sympathetic to big government. For instance, we both testified to the Ways & Means Committee last year about the value-added tax, and he sided with all the other […]

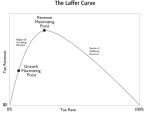

read more...The Laffer Curve Shows that Tax Increases Are a Very Bad Idea – even if They Generate More Tax Revenue

The Laffer Curve is a graphical representation of the relationship between tax rates, tax revenue, and taxable income. It is frequently cited by people who want to explain the common-sense notion that punitive tax rates may not generate much additional revenue if people respond in ways that result in less taxable income. Unfortunately, some people […]

read more...With Washington Now Imposing the World’s Highest Corporate Tax Rate, Every Day is April Fool’s Day for American Companies

Last year, I expressed skepticism that the White House was serious about reducing the corporate tax rate. And, sure enough, when the Obama Administration produced a plan earlier this year, it was a disappointing mix of a few good provisions and several unpalatable proposals. This is unfortunate because the United States has one of the […]

read more...Explaining Pro-Growth Tax Reform to the Senate Budget Committee

What do the flat tax and national sales tax (and even the value-added tax) have in common? As I explain in this Senate Budget Committee testimony, they are all single-rate, consumption-base, loophole-free tax systems that fulfill the key principles of good tax policy. But good theory doesn’t operate in a vacuum, which is why I […]

read more...Should America Copy Europe, as Obama Believes?

Last year, I shared a very amusing Michael Ramirez cartoon showing Obama as the European lemming. Now, Mark Helprin takes a much more serious look at the same issue in the Wall Street Journal, commenting on the wisdom (or lack thereof) of Obama’s interest in the European economic model. Both in his re-election campaign and […]

read more...Should States Be Allowed to Tax Outside their Borders, Particularly if It Means a Database of Your Online Purchases?

Tax competition, as I have explained to the point of being a nuisance, is an important restraint on the greed of the political class. Simply stated, politicians are less like to over-tax and over-spend if they know that geese with the golden eggs can fly across the border. This is mostly an issue in the […]

read more...Three Cheers for this Lawsuit against the Thugs at the IRS

Early in 2010, I wrote about a reprehensible IRS plan to create a cartel in the tax preparation industry, which would screw small firms and entrepreneurs to help line the pockets of big companies such as H&R Block. And, earlier this year, I specifically criticized the IRS Commissioner for moving ahead with this scheme, which […]

read more...IRS Commissioner Bumps into Reality, Learns Nothing and Wants to Make the Tax System Worse

This interview with the IRS Commissioner is really irritating. He wants us to believe that all the problems exist because of bad laws enacted by Congress. I certainly agree that the crowd in Washington is venal, corrupt, and duplicitous. But the IRS takes a bad situation and makes it worse, whether we’re looking at gross […]

read more...If Even the International Monetary Fund Acknowledges the Laffer Curve, Why Doesn’t Obama Realize that Higher Tax Rates are All Pain and No Gain?

I speculated last year that the political elite finally might be realizing that higher tax rates are not the solution to Greece’s fiscal situation. Simply stated, you can only squeeze so much blood out of a stone, and pushing tax rates higher cripples growth and drives more people into the underground economy. Well, it turns […]

read more...New Congressional Budget Office Numbers Once Again Show that Modest Spending Restraint Would Eliminate Red Ink

Back in 2010, I crunched the numbers from the Congressional Budget Office and reported that the budget could be balanced in just 10 years if politicians exercised a modicum of fiscal discipline and limited annual spending increases to about 2 percent yearly. When CBO issued new numbers early last year, I repeated the exercise and […]

read more...