Tag Archives : Taxation

On the Right of Economic Emigration, France Has Better Policy than America

I’ve mocked France on several occasions, and I thought Sarkozy was so bad that I figured (in the long run) the election of Hollande was a step in the right direction. But in certain ways, France isn’t as bad as the United States. The New York Times has a big story about French entrepreneurs and […]

read more...New Study from U.K. Think Tank Shows How Big Government Undermines Prosperity

It seems I was put on the planet to educate people about the negative economic impact of excessive government. Though I must be doing a bad job because the burden of the public sector keeps rising. But hope springs eternal. To help make the case, I’ve cited research from international bureaucracies such as the Organization […]

read more...A Rare Bit of Good News from Europe

It seems that there’s nothing but bad news coming from Europe. Whether we’re talking about fake austerity in the United Kingdom, confiscatory tax schemes in France, or bailouts in Greece, the continent seems to be a case study of failed statism. But that’s not completely accurate. Every so often I highlight good news, such as […]

read more...Facebook Billionaire Gives Up Citizenship to Escape Bad American Tax Policy

It is very sad that America’s tax system is so onerous that some rich people feel they have no choice but to give up U.S. citizenship in order to protect their family finances. I’ve written about this issue before, particularly in the context of Obama’s class-warfare policies leading to an increase in the number of […]

read more...Measuring the Federal Government’s Spending Problem

I’ve complained endlessly that America’s fiscal problem is too much spending, and that deficits and debt are best understood as symptoms of that underlying disease. So I’m obviously a big fan of this new video from the folks at Learn Liberty. I like how they use several types of measurements to show that there’s plenty […]

read more...If You Want To Understand Why Obama’s Tax Agenda Is Bad for Workers, this Picture Says a Thousand Words

A good tax system (like the flat tax) does not impose extra layers of tax on income that is saved and invested. I’ve tried to emphasize this point with a flowchart, and I’ve defended so-called trickle-down economics, which is nothing more than the common-sense notion that investment boosts wages for workers by making them more […]

read more...Comparing Obamanomics with Reaganomics, Looking at Evidence from the States

I’ve done a couple of posts comparing Reaganomics and Obamanomics, mostly based on data from the Minneapolis Federal Reserve on employment and economic output. I even did a TV interview on the subject, which generated some comments on my taste in clothing, and also cited a Richard Rahn column that got Paul Krugman and Ezra […]

read more...Explaining in the New York Post Why Obama’s Soak-the-Rich Tax Policy Is Doomed to Failure

I think high tax rates on certain classes of citizens are immoral and discriminatory. If the government is going to collect revenue, all taxpayers should be treated equally, with something akin to a simple flat tax. But most people don’t seem to care about having the law apply the same to all people, so I […]

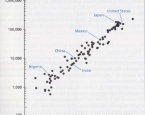

read more...Professor Greg Mankiw: If You Value Individual Liberty, then Protect, Promote, and Preserve Competition Between Governments

Other than my experiment dealing with corporate taxation, the first video I narrated for the Center for Freedom and Prosperity dealt with the issue of tax competition. It was a deliberate choice because I view competition among governments as one of the few effective restraints on the greed of the political class. Simply stated, in […]

read more...The Right Capital Gains Tax Rate Is Zero

The silly debate about the “Buffett Rule” is really an argument about the extent to which there should be more double taxation of income that is saved and invested. Politicians conveniently forget that dividends and capital gains get hit by the corporate income tax. And since America now has the developed world’s highest corporate income […]

read more...