Tag Archives : Taxation

Gerard Depardieu Meets John Galt

Another Frenchman has “gone Galt.” First, it was France’s richest entrepreneur. Now, it’s the nation’s most famous actor. Gerard Depardieu has officially announced – in a letter to France’s thuggish Prime Minister – that he is tired of paying 85 percent of his income to finance the vote-buying actions of France’s kleptocratic political elite. Instead, […]

read more...New Evidence Shows States with No Income Tax Grow Faster and Create More Jobs

One of the key ways of controlling state and local tax burdens, according to this map from the Tax Foundation, is to not have an income tax. But that’s not too surprising. States have just a couple of ways of generating significant tax revenue, so it stands to reason that states without an income tax […]

read more...The $822,000-per-Year Bureaucrat and the Death of California

Hopefully we’re all disgusted when insiders rig the system to rip off taxpayers. And I suspect you’re not surprised to know that the worst examples come from California, which is in a race with Illinois to see which state can become the Greece of America. Well, the Golden State has a new über-bureaucrat. Here are […]

read more...For Both Policy Reasons and Political Reasons, the Fiscal Cliff is Better Than Surrender

It’s never a good idea to display weakness during negotiations. Your opponent will sense your fear and up his demands. That’s certainly what we’re seeing in Washington. The cartoon at this link captures the GOP’s wobbly attitude on taxes, and this interview is about the ever-increasing demands of the Obama Administration. It’s rather galling, by […]

read more...The Link Between High Tax Rates and Corruption

I’ve been very critical of Obama’s class-warfare ideology because it leads to bad fiscal policy. But perhaps it is time to give some attention to other arguments against high tax rates. Robert Samuelson, a columnist for the Washington Post, has a very important insight about tax rates and sleaze in Washington. His column is mostly […]

read more...Learning from the European Experience: Do Higher Tax Burdens Lead to Less Red Ink?

I’ve been arguing against higher taxes because of my concerns that more revenue will simply lead to a bigger burden of government spending. Yes, I realize it is theoretically possible that a tax hike could be part of a political deal that produces a good outcome, such as entitlement reform. But that doesn’t seem to […]

read more...Don’t Get Bamboozled by the Fiscal Cliff: Five Policy Reasons and Five Political Reasons Why Republicans Should Keep their No-Tax-Hike Promises

The politicians claim that they are negotiating about how best to reduce the deficit. That irks me because our fiscal problem is excessive government spending. Red ink is merely a symptom of that underlying problem. But that’s a rhetorical gripe. My bigger concern is that politicians are prevaricating. They’re really talking about higher taxes in […]

read more...Will Obama Learn from England’s Laffer Curve Mistake?

Obama’s main goal in the fiscal cliff negotiations is to impose a class-warfare tax hike. He presumably thinks this will give the government more money to spend, but recent evidence from the United Kingdom suggests that he won’t get nearly as much money as he thinks. Why? Because there’s this thing called the Laffer Curve. […]

read more...White House Agrees with Me, Admits Tax Revenues Will Climb above Long-Run Average Even if All Tax Cuts Are Made Permanent

Earlier this year, I explained that tax revenues would soon climb above their long-run average of 18 percent of GDP, even if the 2001 and 2003 tax cuts were made permanent. In other words, the nation’s fiscal challenge is entirely the result of a rising burden of government spending. Even though the data on tax […]

read more...Obama’s Fiscal Plan: Real Tax Hikes and Fake Spending Cuts

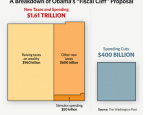

If done well, an image can say a thousand words. The Heritage Foundation shows us what Obama has in mind when he talks about a “balanced” plan. This chart, while horrifying and visually powerful, actually understates the case against Obama. The President is not proposing to cut spending by $400 billion. He’s only proposing to […]

read more...