Tag Archives : Taxation

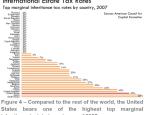

Rather than Helping the Poor, Higher Tax Rates Redistribute Rich People

Daniel Hannan is a member of the European Parliament from England. He is one of the few economically sensible people in that body, as demonstrated in these short clips of him speaking about tax competition and deriding the European Commission’s corrupt racket. And as you can see from his latest article in the UK-based Telegraph, […]

read more...The Great Hillsdale College Debate: Flat Tax or Fair Tax?

I’m at Hillsdale College in Michigan for a conference on taxation. The event is called “The Federal Income Tax: A Centenary Consideration,” though I would have called it something like “100 Years of Misery from the IRS.” I’m glad to be here, both because Hillsdale proudly refuses to take government money (which would mean being […]

read more...California’s One-Man Laffer Curve

I’ve already condemned the foolish people of California for approving a referendum to raise the state’s top tax rate to 13.3 percent. This impulsive and misguided exercise in class warfare surely will backfire as more and more productive people flee to other states – particularly those that don’t impose any state income tax. We know […]

read more...Just Because California Is Terrible, that Doesn’t Mean Texas Is Perfect

Texas is in much better shape than California. Taxes are lower, in part because Texas has no state income tax. No wonder the Lone Star State is growing faster and creating more jobs. And the gap will soon get even wider since California voters recently decided to drive away more productive people by raising top […]

read more...Based on a Review of Studies Looking at the Impact of Taxes on Growth, Academic Research Gives Obama a Record of 0-23-3

How do you define a terrible team? No, this isn’t going to be a joke about Notre Dame foolishly thinking it could match up against a team from the Southeastern Conference in college football’s national title game (though the Irish win the contest for prettiest make-believe girlfriends). I’m asking the question because a winless record […]

read more...The Basket Case Sometimes Known as Japan

Good fiscal policy doesn’t require heavy lifting. Governments simply need to limit the burden of government spending. The key variable is making sure spending doesn’t consume ever-larger shares of economic output. In other words, follow Mitchell’s Golden Rule. It’s possible for a nation to have a large public sector and be fiscally stable. Growth won’t […]

read more...Do Higher Tax Rates Hurt Growth?

Because of Obama’s class-warfare tax hike and additional tax increases by kleptocrats at the state level, many successful taxpayers will now lose more than 50 percent of any additional income they generate for the American economy. I discuss the implications of this punitive tax policy in this CNBC interview. Normally, this is the section where […]

read more...The “National Taxpayer Advocate” at the IRS is Advocating for the Government, Not Taxpayers

I’m not a big fan of the Internal Revenue Service, though I try to make sure that politicians get much of the blame for America’s convoluted, punitive, and unfair tax code. Heck, just look at these three images – here, here, and here – and you’ll find startling evidence that politicians make the tax system […]

read more...Do Tax Cuts “Starve the Beast”?

There’s a debate among policy wonks about whether a no-tax-hike policy is an effective way of restraining the burden of government spending. At the risk of over-simplifying, the folks who support the “starve the beast” theory argue that there are political and/or economic limits to government borrowing, so if you don’t let politicians tax more, […]

read more...The Only Good Death Tax is a Dead Death Tax

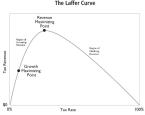

Just before the end of the year, I shared some fascinating research about people dying quicker or living longer when there are changes in the death tax. Sort of the ultimate Laffer Curve response, particularly if it’s the former. But the more serious point is that the death tax shouldn’t exist at all, as I’ve […]

read more...