by CF&P | Dec 18, 2017 | News, Press Releases

Center for Freedom and Prosperity For Immediate Release Monday, December 18, 2017 202-285-0244 www.freedomandprosperity.org CF&P Joins Coalition Supporting Tax Cuts and Jobs Act (Washington, D.C., Monday, December 18, 2017) – A coalition of 36 free-market...

by Dan Mitchell | Dec 17, 2017 | Blogs, Health Care, Taxation

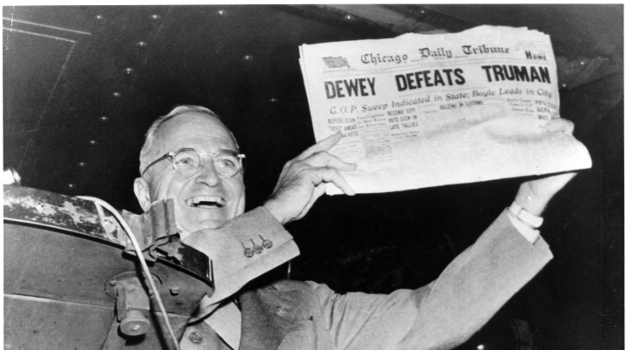

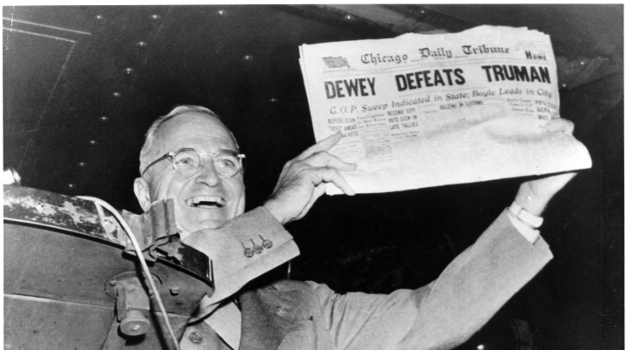

I don’t focus much on media bias because journalists generally aren’t dishonest. Instead, they choose which stories to highlight or downplay based on what advances their political agenda. Though every so often I’ll highlight an example of where bias leads to an...

by Dan Mitchell | Dec 15, 2017 | Blogs, Economics, Taxation

Adopting tax reform (even a watered-down version of tax reform) is not easy. Some critics say it will deprive the federal government of too much money (a strange argument since it will be a net tax increase starting in 2027). Some critics say it will make it more...

by Dan Mitchell | Dec 14, 2017 | Blogs, Taxation

In early November, I reviewed the House’s tax plan and the Senate’s tax plan. I was grading on a curve. I wasn’t expecting or hoping for something really bold like a flat tax. Instead, I simply put forward a wish list of a few incremental reforms that would make an...

by Dan Mitchell | Dec 10, 2017 | Blogs, Economics, Taxation

Both the House and Senate have approved reasonably good tax reform plans. Lawmakers are now in a “conference committee” to iron out the differences between the two bills so that a consensus package can be a approved and sent to the White House for the President’s...