by Dan Mitchell | Feb 28, 2020 | Blogs, Taxation

This CF&P video is nearly 10 years old, so some of the numbers are outdated, but the seven reasons to reject tax increases are still very relevant. I’m recycling the video because the battle over tax increases is becoming more heated. Indeed, depending on what...

by Dan Mitchell | Feb 14, 2020 | Big Government, Blogs, Flat Tax, Government Spending, States, Taxation

The most important referendum in 2019 was the effort to get Colorado voters to eviscerate the Taxpayer Bill of Rights. Fortunately, the people of the Centennial State comfortably rejected the effort to bust the state’s successful spending cap. The most important...

by Dan Mitchell | Feb 3, 2020 | Big Government, Blogs, Taxation, Welfare and Entitlements

Assuming he was able to impose his policy agenda, I think Bernie Sanders – at best – would turn America into Greece. In more pessimistic moments, I fear he would turn the U.S. into Venezuela. The Vermont Senator and his supporters say that’s wrong and that the real...

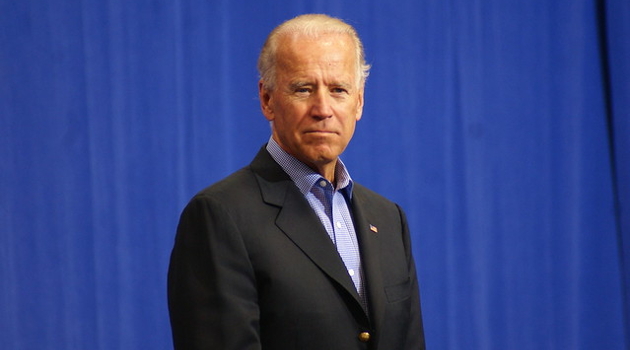

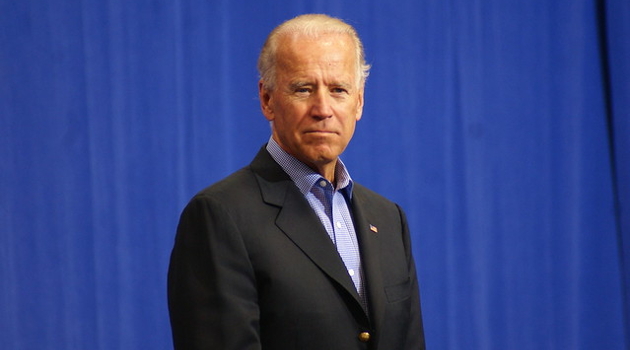

by Dan Mitchell | Jan 22, 2020 | Big Government, Blogs, Government Spending, Taxation

Given their overt statism, I’ve mostly focused on the misguided policies being advocated by Bernie Sanders and Elizabeth Warren. But that doesn’t mean Joe Biden’s platform is reasonable or moderate. Ezra Klein of Vox unabashedly states that the former Vice President’s...

by Dan Mitchell | Jan 3, 2020 | Blogs, Taxation

I want more people to become rich. That’s why I support free markets. But a few already-rich people say such silly things that I wonder whether a big bank account somehow can lead to a loss of common sense. For background information on this issue, there’s...