by Dan Mitchell | Dec 20, 2022 | Blogs, Tax Competition, Taxation

The economic outlook in New York (both the state and the city) has been very depressing in recent years. New York is ranked #50 in the Economic Freedom of North America.New York is ranked #48 in the State Business Tax...

by Dan Mitchell | Oct 5, 2022 | Blogs, Tax Competition, Taxation

A big division among economists is whether taxes have a big or small impact on incentives. If taxpayers are very responsive, that means more economic damage (to use the profession’s jargon, a greater level of deadweight loss). If you’re wondering which economists...

by Dan Mitchell | Jul 10, 2022 | Blogs, Tax Competition, Taxation

I’ve written many times about the importance of low tax rates, specifically low marginal tax rates on productive activity such as work, saving, investment, and entrepreneurship. And I’ve explained that it is especially beneficial to have...

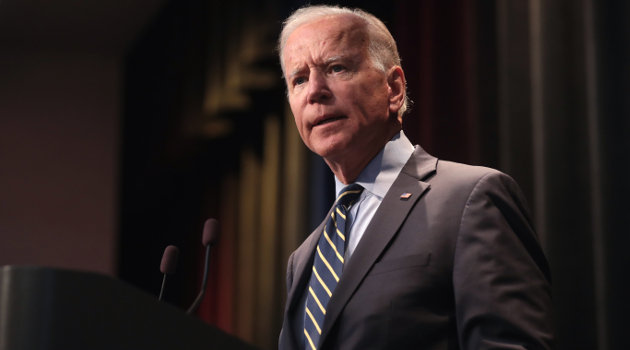

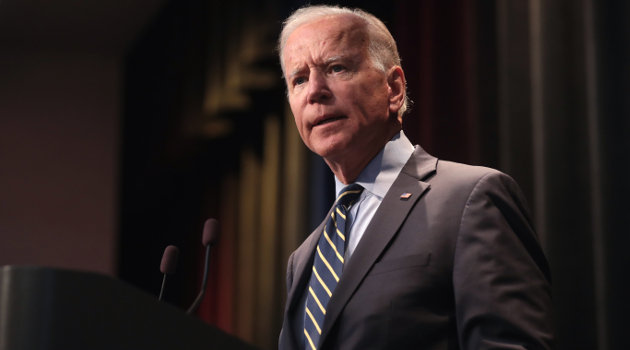

by Dan Mitchell | Jun 22, 2022 | Blogs, Tax Competition, Taxation

As part of my continuing efforts to derail Biden’s global minimum tax on businesses (here’s Part I and Part II), I explain the downsides of the president’s plan in this clip from a recent interview. If you don’t want to spend three minutes to watch the above video, my...

by Dan Mitchell | Jun 4, 2022 | Blogs, States, Tax Competition, Taxation

I’ve already shared the “feel-good story” for 2022, so today I’m going to share this year’s feel-good map. Courtesy of the Tax Foundation, here are the states that have lowered personal income tax rates and/or corporate income tax rates in 2021 and 2022....