Tag Archives : Supply-side economics

The Laffer Curve Shows that Tax Increases Are a Very Bad Idea – even if They Generate More Tax Revenue

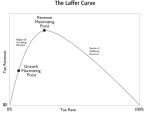

The Laffer Curve is a graphical representation of the relationship between tax rates, tax revenue, and taxable income. It is frequently cited by people who want to explain the common-sense notion that punitive tax rates may not generate much additional revenue if people respond in ways that result in less taxable income. Unfortunately, some people […]

read more...Even Officials from the Clinton Administration Agree that the United States Should Have a Lower Corporate Tax Rate

Since the Clinton Administration turned out to be much more market-oriented than either his GOP predecessor or successor, this isn’t quite a man-bites-dog story. Nonetheless, it is still noteworthy that Elaine Kamarck, a high-level official from the Clinton White House, has a column on a left-of-center website arguing in favor of a pro-growth, supply-side corporate […]

read more...Alan Blinder’s Accidental Case for the Flat Tax

Alan Blinder has a distinguished resume. He’s a professor at Princeton and he served as Vice Chairman of the Federal Reserve. So I was interested to see he authored an attack on the flat tax – and I was happy after I read his column. Why? Well, because his arguments are rather weak. So anemic […]

read more...A Lesson on the Laffer Curve for Barack Obama

One of my frustrating missions in life is to educate policy makers on the Laffer Curve. This means teaching folks on the left that tax policy affects incentives to earn and report taxable income. As such, I try to explain, this means it is wrong to assume a simplistic linear relationship between tax rates and […]

read more...A Victory for the Laffer Curve, a Defeat for England’s Economy

A new study from the Adam Smith Institute in the United Kingdom provides overwhelming evidence that class-warfare tax policy is grossly misguided and self-destructive. The authors examine the likely impact of the 10-percentage point increase in the top income tax rate, which was imposed as an election-year stunt by former Gordon Brown and then kept […]

read more...Suddenly, I Like Soccer (at least When It Confirms Supply-Side Economics, Tax Competition, and the Laffer Curve)

I don’t particularly like soccer and I’m not normally a fan of the research of Professor Emannuel Saez, so it is rather surprising that I like Professor Saez’s new research on taxes and soccer. While Saez may have a reputation for doing work that often is used by advocates of class warfare, his latest research […]

read more...A Laffer Curve Tutorial

Greetings from frigid Minnesota. I’m in this misplaced part of the North Pole to testify before both the Senate and House Tax Committees today on issues related to the Laffer Curve. In other words, I will be discussing how governments should measure the revenue impact of changes in tax policy – what is sometimes known […]

read more...The Super Bowl of Taxation

The Wall Street Journal uses the clash between the Steelers and Packers as an opportunity to make a much-need point about taxes. Because of Pennsylvania’s flat tax, Ben Roethlisberger keeps a greater percentage of his salary than Aaron Rodgers, who gets raped by Wisconsin’s “progressive” tax system. Packers fans shouldn’t worry about this, though, since […]

read more...