Tag Archives : Supply-side economics

Do Higher Tax Rates Hurt Growth?

Because of Obama’s class-warfare tax hike and additional tax increases by kleptocrats at the state level, many successful taxpayers will now lose more than 50 percent of any additional income they generate for the American economy. I discuss the implications of this punitive tax policy in this CNBC interview. Normally, this is the section where […]

read more...Class Warfare Tax Policy Causes Portugal to Crash on the Laffer Curve, but Will Obama Learn from this Mistake?

Back in mid-2010, I wrote that Portugal was going to exacerbate its fiscal problems by raising taxes. Needless to say, I was right. Not that this required any special insight. After all, no nation has ever taxed its way to prosperity. We’re now at the end of 2012 and Portugal is still saddled with a […]

read more...Once Obama’s Policies Are Implemented Next Year, U.S. Capital Gains Tax Rate Will be 70 percent Higher than Global Average

Back in September, I shared a very good primer on the capital gains tax from the folks at the Wall Street Journal, which explained why this form of double taxation is so destructive. I also posted some very good analysis from John Goodman about the issue. Unfortunately, even though the United States already has a […]

read more...Will Obama Learn from England’s Laffer Curve Mistake?

Obama’s main goal in the fiscal cliff negotiations is to impose a class-warfare tax hike. He presumably thinks this will give the government more money to spend, but recent evidence from the United Kingdom suggests that he won’t get nearly as much money as he thinks. Why? Because there’s this thing called the Laffer Curve. […]

read more...A Laffer Curve Warning about the Economy and Tax Revenue for President Obama and other Class Warriors

Being a thoughtful and kind person, I offered some advice last year to Barack Obama. I cited some powerful IRS data from the 1980s to demonstrate that there is not a simplistic linear relationship between tax rates and tax revenue. In other words, just as a restaurant owner knows that a 20-percent increase in prices […]

read more...Richard Epstein Discusses the Flat Tax

In addition to being my former debating partner, Richard Epstein is one of America’s premiere public intellectuals. You can watch him make mincemeat out of George Soros in this video, for instance, and you can listen to his astute observations about his former law school colleague Barack Obama in this video. Given his stature, I’m […]

read more...The Joint Committee on Taxation’s Head-in-the-Sand Approach to the Laffer Curve

I’m a big believer in the Laffer Curve, which is the common-sense proposition that changes in tax rates don’t automatically mean proportional changes in tax revenue. This is because you also have to think about what happens to taxable income, which can move up or down in response to changes in tax policy. The key […]

read more...Spending Cuts and Tax Cuts Should Be an All-of-the-Above Option, Not an Either-Or Choice

I’m in Slovenia where I just finished indoctrinating educating a bunch of students on the importance of Mitchell’s Golden Rule as a means of restraining the burden of government spending. And I emphasized that the fiscal problem in Europe is the size of government, not the fact that nations are having a hard time borrowing […]

read more...The Laffer Curve Wreaks Havoc in the United Kingdom

Back in 2010, I excoriated the new Prime Minister of the United Kingdom, noting that David Cameron was increasing tax rates and expanding the burden of government spending (including an increase in the capital gains tax!). I also criticized Cameron for leaving in place the 50 percent income tax rate imposed by his feckless predecessor, […]

read more...If You Want To Understand Why Obama’s Tax Agenda Is Bad for Workers, this Picture Says a Thousand Words

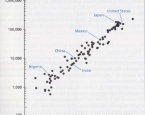

A good tax system (like the flat tax) does not impose extra layers of tax on income that is saved and invested. I’ve tried to emphasize this point with a flowchart, and I’ve defended so-called trickle-down economics, which is nothing more than the common-sense notion that investment boosts wages for workers by making them more […]

read more...