Tag Archives : Supply-side economics

The Punitive Economic Cost of Class-Warfare Taxation

I’ve already shared a bunch of data and evidence on the importance of low tax rates. A review of the academic evidence by the Tax Foundation found overwhelming support for the notion that lower tax rates are good for growth. An economist from Cornell found lower tax rates boost GDP. Other economists found lower tax rates boost job creation, savings, […]

read more...Lower Tax Rates vs. Targeted Tax Credits, Part II

I wrote a column for the Wall Street Journal last week about the policy debate over whether it’s better to lower tax rates or to provide targeted tax cuts for parents. Since this meant I was wading into a fight between so-called reform conservatives (or “reformicons”) and traditional conservatives (or “supply-siders”), I wasn’t surprised to learn that not everyone […]

read more...Lower Tax Rates > Targeted Tax Credits

Some folks on the right in Washington, generally known as reformicons (short for reform conservatives), want the Republican Party to de-emphasize marginal tax rate reductions and instead focus on providing tax relief to parents. There are many leaders in this movement and, if you want to learn more about the tax proposals being discussed, I […]

read more...France Wipes Out on the Laffer Curve

If you appreciate the common-sense notion of the Laffer Curve, you’re in for a treat. Today’s column will discuss the revelation that Francois Hollande’s class-warfare tax hikes have not raised nearly as much money as predicted. And after the recent evidence about the failure of tax hikes in Hungary, Ireland,Detroit, Italy, Portugal, the United Kingdom, and the United States, this news from the BBC probably should be […]

read more...A Primer on the Laffer Curve to Help Understand Why Obama’s Class-Warfare Tax Policy Won’t Work

My main goal for fiscal policy is shrinking the size and scope of the federal government and lowering the burden of government spending. But I’m also motivated by a desire for better tax policy, which means lower tax rates, less double taxation, and fewer corrupting loopholes and other distortions. One of the big obstacles to good tax policy is that many statists […]

read more...Progress on the Laffer Curve*

The title of this piece has an asterisk because, unfortunately, we’re not talking about progress on the Laffer Curve in the United States. Even Keynes himself accepted this. Like many other economists throughout the ages, he understood and agreed with the principles that underpinned what eventually came to be known as the Laffer curve: that […]

read more...Two Lessons from Calvin Coolidge

Last month, Amity Shlaes came to Cato to discuss her superb new book about Calvin Coolidge. I heard her discuss the book back in January while participating in Hillsdale College’s conference on the 100th anniversary of the income tax, but the book is so rich with information that I was glad for the opportunity to […]

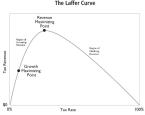

read more...Quit Dodging the Issue and Tell Us the Revenue-Maximizing Point on the Laffer Curve

I feel like I’m on the witness stand and I’m being badgered by a hostile lawyers. Readers keep asking me to identify the revenue-maximizing point on the Laffer Curve. But I don’t like that question. In the past, I’ve explained that the growth-maximizing point on the Laffer Curve is where enough revenue is raised to […]

read more...California’s One-Man Laffer Curve

I’ve already condemned the foolish people of California for approving a referendum to raise the state’s top tax rate to 13.3 percent. This impulsive and misguided exercise in class warfare surely will backfire as more and more productive people flee to other states – particularly those that don’t impose any state income tax. We know […]

read more...Based on a Review of Studies Looking at the Impact of Taxes on Growth, Academic Research Gives Obama a Record of 0-23-3

How do you define a terrible team? No, this isn’t going to be a joke about Notre Dame foolishly thinking it could match up against a team from the Southeastern Conference in college football’s national title game (though the Irish win the contest for prettiest make-believe girlfriends). I’m asking the question because a winless record […]

read more...