Tag Archives : Obamacare

Repealing Obamacare Won’t Solve the Healthcare Mess (but It’s a Good Start)

I’ve often complained that government-created third-party payer is the main problem with America’s healthcare system, and I was making that point well before Obamacare was imposed upon the country. Simply stated, people won’t be smart consumers and providers won’t compete to keep costs low when the vast majority of expenses are paid for either by […]

read more...Third-Party Payer is the Biggest Economic Problem With America’s Health Care System

This mini-documentary from the Center for Freedom and Prosperity Foundation explains that “third-party payer” is the main problem with America’s health care system. This is why undoing Obamacare, while desirable, is just a small first step if we want to reduce costs and boost efficiency.

read more...Obamacare’s Corrupt Conception, Sleazy Gestation, and Tawdry Birth

One of my very first blog posts was about the link between big government and big corruption. For the rest of my life, I can now cite the Obamacare travesty as an example. Here’s some of what Tim Carney wrote for the Washington Examiner. Chief Justice John Roberts’ judicial sleight of hand, transforming Obamacare’s mandate […]

read more...Yes, the Federal Government Has a Broad Power to Tax, but that’s Different from Having a Green Light to Spend

’m not a lawyer, or an expert on the Constitution, though I sometimes play one on TV. But I can read, and I’ll agree with my friends on the left that the federal government has a broad power to tax. I wish the 16th Amendment had never been ratified, but its language gives the federal […]

read more...If Obamacare Is Constitutional, then Why Did the Founding Fathers Bother with a List of Enumerated Powers?

I think Obamacare is bad policy because it exacerbates the main problem with the current healthcare system, which is third-party payer. And as a public finance economist, I’m obviously not happy about the new taxes and additional spending in Obamacare. But those issues are temporarily on the back burner now that the Supreme Court is […]

read more...New Research Shows Obamacare Resulted in 25 Additional Democratic Losses in 2010 Elections, but Was It a Long-Term Victory for the Left?

I like to think people in the United States still believe in liberty, and I’ve cited some polling data in support of American Exceptionalism. And it seems like that philosophical belief in individualism and limited government sometimes has an impact in the polling booth. According to a recent study, Obamacare was poison for Democrats in […]

read more...In the Entire World, Is there Anybody Who Is Surprised that Obamacare Is Turning Out to Be Far More Expensive than the President Promised?

Washington is filled with people who exaggerate, prevaricate, dissemble, and obfuscate. And those are the people I like. The ones I don’t like are much worse. That’s why, during the Obamacare debate, I warned that the numbers were utterly dishonest. We were told, if you remember those grim days, that adopting a giant new entitlement […]

read more...New Academic Study Confirms Previous IMF Analysis, Shows that Lower Tax Rates Are the Best Way to Reduce Tax Evasion

Leftists want higher tax rates and they want greater tax compliance. But they have a hard time understanding that those goals are inconsistent. Simply stated, people respond to incentives. When tax rates are punitive, folks earn and report less taxable income, and vice-versa. When tax rates increase, sometimes they engage in tax avoidance, lowering their […]

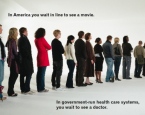

read more...More Great Moments in Government-Run Healthcare

Even though Paul Krugman has told us that horror stories about government-run healthcare in Britain “are false,” we keep getting reports about substandard care and needless deaths (see here, here, here, here, here, here, here, here, and here). Well, let’s add another chilling report to the list. Here’s some of what the UK-based Telegraph just […]

read more...A Painful Example of Obamacare’s Tax Complexity

As this image illustrates, the internal revenue code is a nightmare of complexity. And this chart shows how Obamacare is turning the health care system into a Byzantine nightmare. So what happens when you mix bad tax policy and bad health care policy? Well, you get this chart, which shows the maze that small business […]

read more...