by Dan Mitchell | Aug 4, 2011 | Big Government, Blogs, Financial Privacy, Regulations, Tax Competition, Taxation

Senator Rubio continues to impress with his Reagan-like efforts to restrain government and promote growth. His latest initiative is legislation to curtail rogue IRS bureaucrats who are seeking to use regulatory edicts to overturn 90 years of law. Here are excerpts...

by CF&P | Jul 20, 2011 | News, Press Releases

Center for Freedom and Prosperity For Immediate Release Wednesday, July 20, 2011 202-285-0244 www.freedomandprosperity.org CF&P Applauds Congressional Effort to Rein in IRS and Prevent Implementation of Destructive Regulation (Washington, D.C., Wednesday, July 20,...

by Brian Garst | May 24, 2011 | Blogs, Economics, Taxation

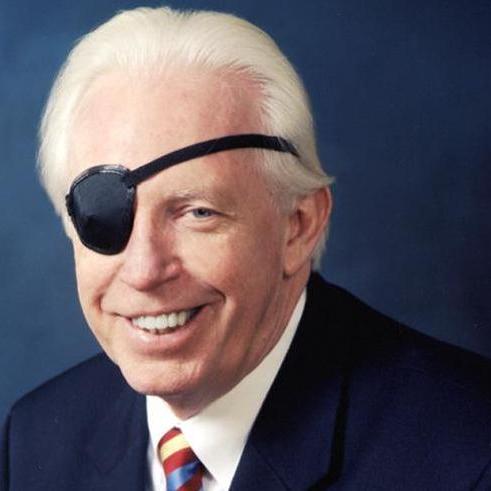

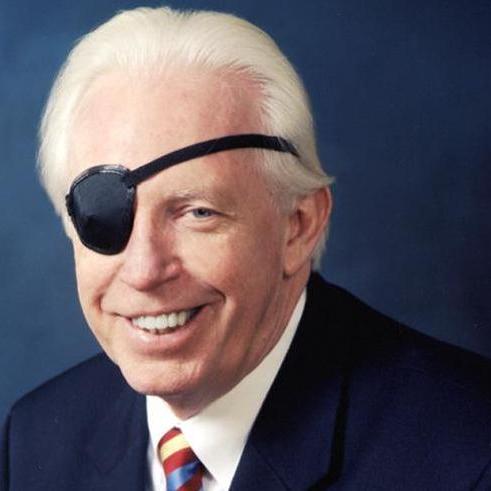

Richard Rahn writes in the Washington Times today on a pair of regulations which he describes as “national economic suicide.” At issue is the IRS’s proposed regulation that would require U.S. banks to report information on foreign account holders,...

by CF&P | May 20, 2011 | News, Press Releases

For Immediate Release Friday, May 20, 2011 202-285-0244 www.freedomandprosperity.org Coalition for Tax Competition Members Testify Against Destructive Regulation at IRS Hearing (Washington, D.C., Friday, May 20, 2011) Led by the Center for Freedom and Prosperity,...

by Andrew F. Quinlan | May 18, 2011 | Blogs, Financial Privacy

Almost ten years after first testifying against a proposal by the IRS to collect unnecessary information from foreign deposit holders, which would then be turned over to foreign governments, I once again represented CF&P and the Coalition for Tax Competition in...