by Dan Mitchell | Jan 26, 2022 | Big Government, Blogs

In the libertarian fantasy world, we would have competing private currencies. In the real world, we have a government central bank. And central banks have a track record of bad monetary policy, so here’s my two cents on how people can try to protect their...

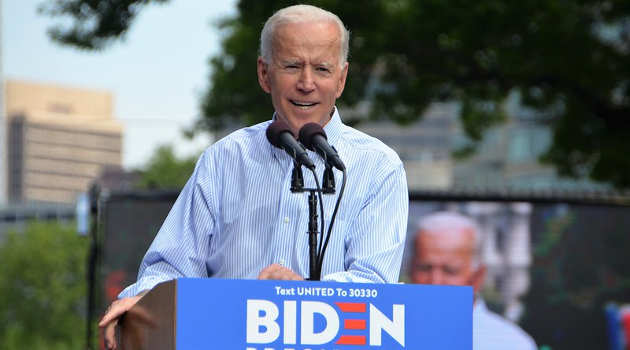

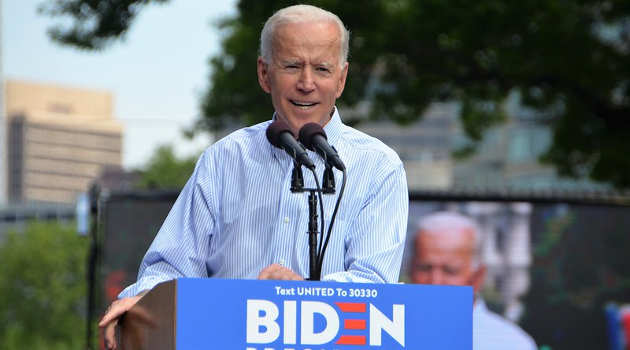

by Dan Mitchell | Jan 3, 2021 | Big Government, Blogs, Economics, Government Spending, Taxation

In an interview with Fox Business last week, I touched on three policies (easy money from the Fed, Biden’s class-warfare tax agenda, and the ever-increasing burden of federal spending) that create risks for the economy in 2021. I didn’t have a chance to elaborate in...

by Dan Mitchell | Dec 13, 2020 | Blogs, Economics

I’m not a fan of the European Union, which has morphed from something good (a free-trade pact) to something bad (a pro-centralization, wannabe United States of Europe that exacerbates the continent’s tax-and-spend mentality). Indeed, that’s why I’m a huge fan of...

by Dan Mitchell | Mar 20, 2020 | Taxation

There will be many lessons that we hopefully learn from the current crisis, most notably that it’s foolish to give so much regulatory power to sloth-like bureaucracies such as the FDA and CDC. Today, I want to focus on a longer-run lesson, which is how tax policy...

by Dan Mitchell | Mar 4, 2020 | Blogs, Economics, Monetary Policy

The coronavirus is a genuine threat to prosperity, at least in the short run, in large part because it is causing a contraction in global trade. The silver lining to that dark cloud is that President Trump may learn that trade is actually good rather than bad. But...