by Dan Mitchell | Apr 16, 2022 | Blogs, Economics

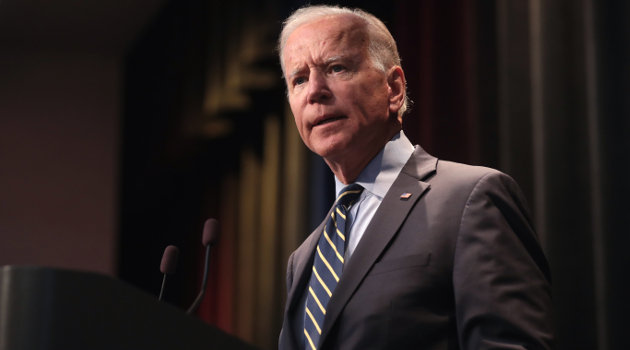

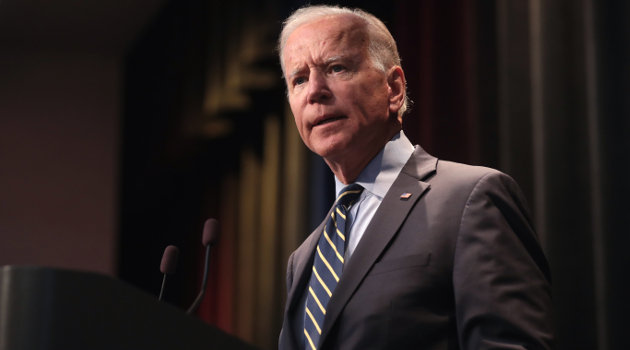

I’m more than happy to condemn Joe Biden for his bad policy proposals, such as higher tax rates, fake stimulus, red tape, and a bigger welfare state. But as I discuss in this segment from a recent interview, he bears very little blame for today’s...

by Dan Mitchell | Mar 28, 2022 | Big Government, Blogs

The good thing about being a policy-driven libertarian is that I don’t feel any need to engage in political spin. I can praise Democrats who do good things and praise Republicans who do good things. And...

by Dan Mitchell | Mar 4, 2022 | Big Government, Blogs

Yesterday’s column explained that Biden’s proposals to expand the welfare state were bad news, in part because government subsidies often lead to inefficiency and higher prices. That’s not a smart strategy when inflation already is at...

by Dan Mitchell | Feb 18, 2022 | Blogs, Crime, Society, Taxation

My friends sometimes tell me that libertarians are too extreme because we tend to make “slippery slope” arguments against government expansions. I respond by pointing out that many slopes are very slippery. Especially when dealing with politicians and...

by Dan Mitchell | Feb 1, 2022 | Blogs, Economics

Every few years (2012, 2015, 2019), I warn that easy-money policies by the Federal Reserve are misguided. But not just because such policies eventually can lead to price inflation, which now has become a problem in the United States. Bad monetary policy also...