by Dan Mitchell | Jul 14, 2022 | Blogs, Monetary Policy

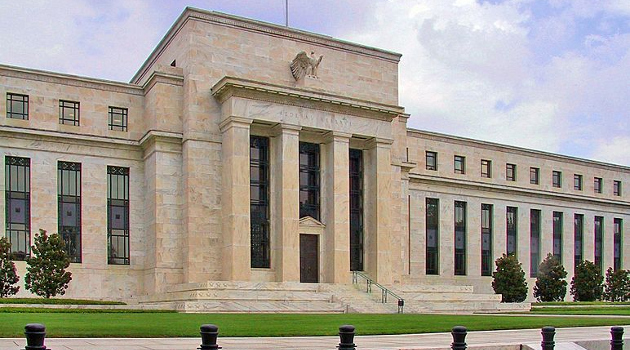

Milton Friedman wisely observed that inflation is always the result of bad monetary policy by central banks. And I echoed that point last month in remarks to the European Resource Bank meeting in Stockholm. This topic deserves more attention, particularly given...

by Dan Mitchell | May 24, 2022 | Big Government, Blogs, Europe, Monetary Policy, Welfare and Entitlements

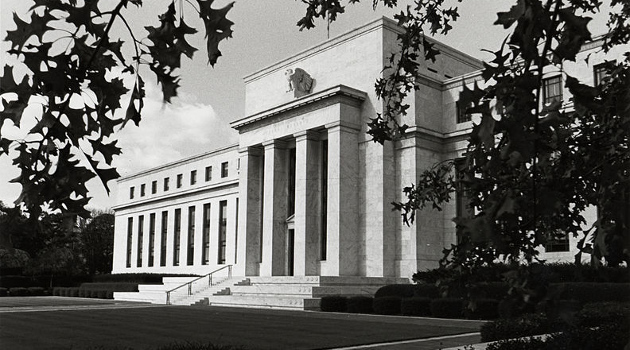

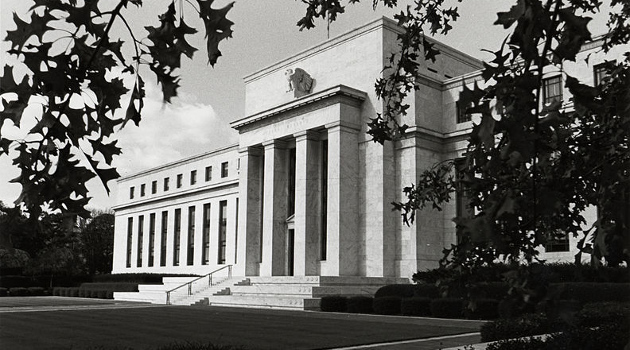

Earlier this year, I pointed out that President Biden should not be blamed for rising prices. There has been inflation, of course, but the Federal Reserve deserves the blame. More specifically, America’s central bank responded to the coronavirus...

by Dan Mitchell | May 7, 2022 | Blogs, Monetary Policy

Back in 2015, I explained to Neil Cavuto that easy money creates the conditions for a boom-bust cycle. It’s now 2022 and my argument is even more relevant. That’s because the Federal Reserve panicked at the start of the pandemic and dumped a massive amount of...

by Dan Mitchell | Apr 24, 2022 | Big Government, Blogs

No sensible person wants to copy the big-spending policies of failed welfare states such as Greece. Unfortunately, many politicians lack common sense (or, more accurately, they are motivated by short-run political ambition rather than...

by Dan Mitchell | Apr 23, 2022 | Big Government, Blogs

Looking back on the 2008 financial crisis, it seems clear that much of that mess was caused by bad government policy, especially easy money from the Federal Reserve and housing subsidies from Fannie Mae and Freddie Mac. Many of my left-leaning...