by Dan Mitchell | May 20, 2021 | Blogs, Economics, Taxation

About one week ago, I shared some fascinating data from the Tax Foundation about how different nations penalize saving and investment, with Canada being the worst and Lithuania being the best. I started that column by noting that there are three important...

by Dan Mitchell | Oct 4, 2020 | Blogs, Economics, Supply Side, Tax Competition, Taxation

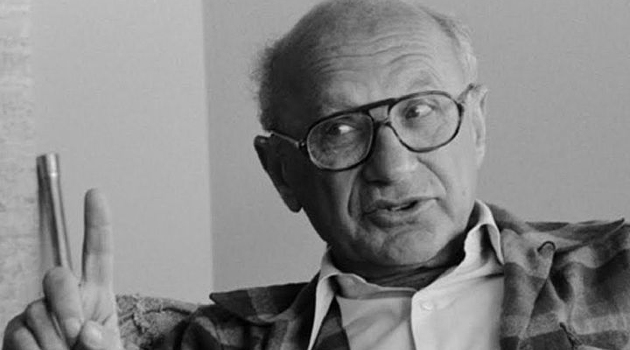

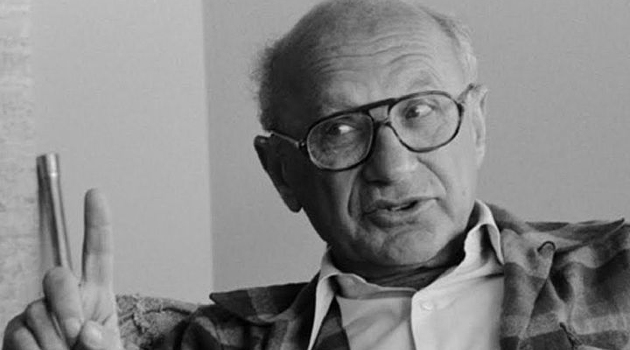

Yesterday’s column featured some of Milton Friedman’s wisdom from 50 years ago on how a high level of societal capital (work ethic, spirit of self-reliance, etc) is needed if we want to limit government. Today, let’s look at what he said back then about that era’s...

by Dan Mitchell | Aug 29, 2020 | Blogs, Economics, Taxation

Two weeks ago, I shared some video from a presentation to the New Economic School of Georgia (the country, not the state) as part of my “Primer on the Laffer Curve.” Here’s that portion of that presentation that outlines the principles of sensible taxation. Just in...

by Dan Mitchell | Jun 4, 2020 | Big Government, Blogs, Taxation, Welfare and Entitlements

Back in 2016, I shared an image that showed how the welfare state punishes both the poor and rich. Rich people are hurt for the obvious reason. They get hit with the highest statutory tax rates, and also bear the brunt of the double taxation (the extra layers of tax...

by Dan Mitchell | Oct 30, 2019 | Blogs, Economics, Supply Side, Taxation

In some cases, politicians actually understand the economics of tax policy. It’s quite common, for instance, to hear them urging higher taxes on tobacco because they want to discourage smoking. I don’t think it’s their job to tell people how to live their lives, but I...