by Dan Mitchell | Nov 18, 2021 | Blogs, Taxation

Immediately after election day in early November, I applauded voters in the (very blue) state of Washington. They wisely expressed their opposition to a plan by state politicians to impose a capital gains tax. And it wasn’t even close. Voters said...

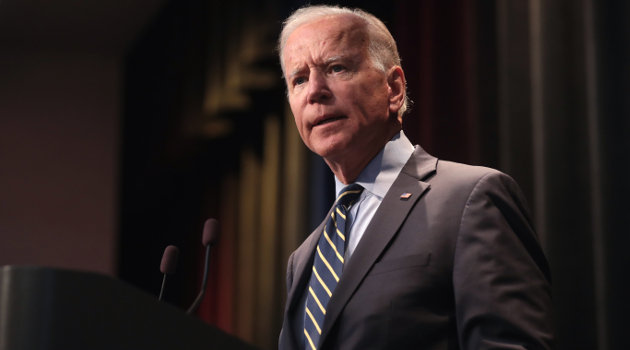

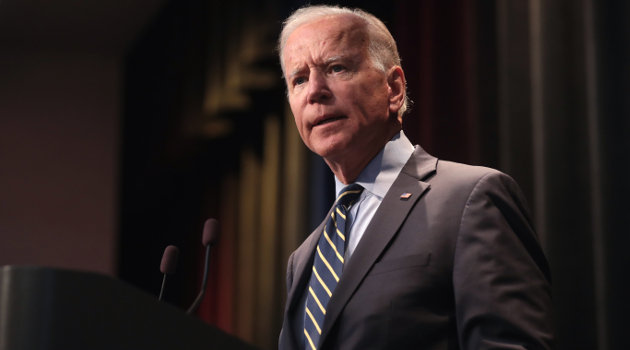

by Dan Mitchell | Oct 29, 2021 | Blogs, Taxation

The good news is that President Biden wants the United States to be at the top. The bad news is that he wants America to be at the top in bad ways. The highest corporate income tax rate.The highest capital gains tax...

by Dan Mitchell | Sep 14, 2021 | Blogs, Taxation

When I discuss class-warfare tax policy, I want people to understand deadweight loss, which is the term for the economic output that is lost when high tax rates discourage work, saving, investment, and entrepreneurship. And I especially want them to understand...

by Dan Mitchell | Sep 10, 2021 | Big Government, Blogs, Economics, Welfare and Entitlements

The welfare state and the so-called war on poverty has been very bad news for taxpayers. But it’s also very bad news for poor people, in part because various redistribution programs can lure them out of the productive economy and...

by Dan Mitchell | Jun 20, 2021 | Blogs, Economics, Supply Side, Taxation

When studying the economic of taxation, one of the most important lessons is that there should be low marginal tax rates on work, saving, investment, and entrepreneurship. That’s also the core message of this video from Prof. John Cochrane. I...