by Dan Mitchell | Sep 1, 2023 | Blogs, Taxation

I wrote in 2017 that class warfare in the 1950s did not work because well-to-do taxpayers could choose to earn less, evade taxes, or avoid taxes. In this video, Brian Domitrovic elaborates on the failure of confiscatory tax rates. Let’s dig deeper...

by Dan Mitchell | Jun 9, 2023 | Blogs, Economics, States, Taxation

Other than doing very well in rankings of state pension debt (see here, here, and here), I’ve never had any reason to notice public policy in Nebraska. That changes today because the Cornhusker State has – like about two dozen other states –...

by Dan Mitchell | May 3, 2023 | Blogs, Taxation

In past columns on the topic of basic income, most of my attention has focused on how universal handouts would undermine the work ethic. To be succinct, I fear that a non-trivial share of the population would exit the labor force if they...

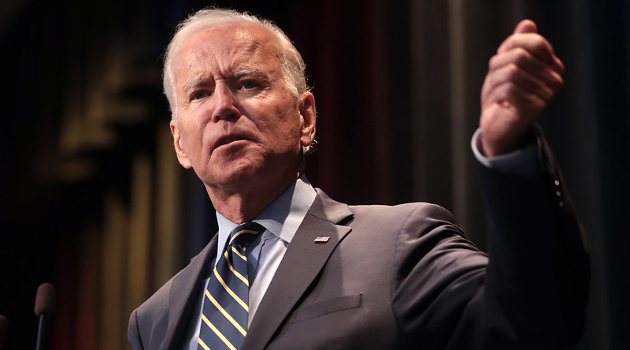

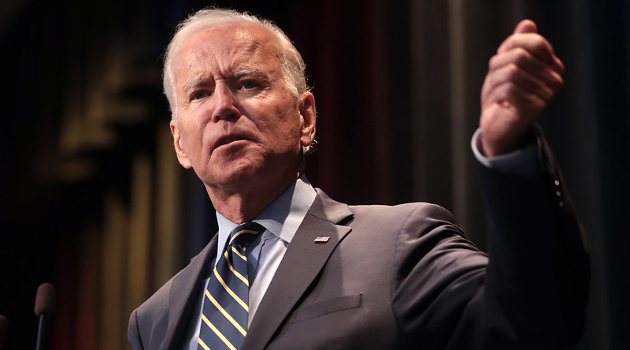

by Dan Mitchell | Mar 16, 2023 | Blogs, Taxation

Last week, I wrote about Biden’s proposed budget, focusing on the aggregate increase in the fiscal burden. Today, let’s take a closer look at his class-warfare tax proposals. Consider this Part VI in a series (Parts I-V can be...

by Dan Mitchell | Feb 28, 2023 | Blogs, Taxation

Marginal tax rates (how much you are taxed for earning additional money) have a big impact on incentives to engage in productive activity such as work, saving, investment, and entrepreneurship. This is why governments should keep tax rates at modest levels. But as you...