by Dan Mitchell | Feb 8, 2014 | Blogs, Economics, Laffer Curve, Taxation

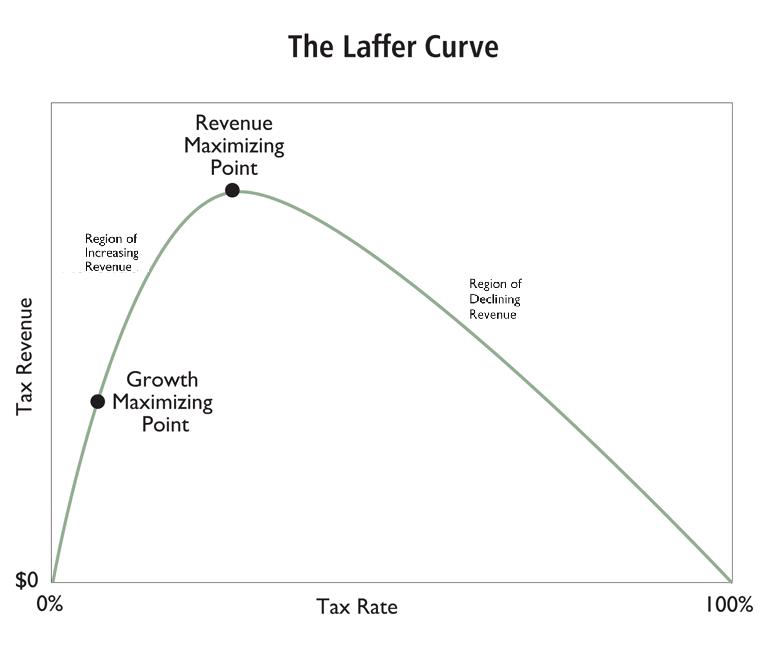

My main goal for fiscal policy is shrinking the size and scope of the federal government and lowering the burden of government spending. But I’m also motivated by a desire for better tax policy, which means lower tax rates, less double taxation, and fewer corrupting...

by Dan Mitchell | Feb 4, 2014 | Blogs, Taxation

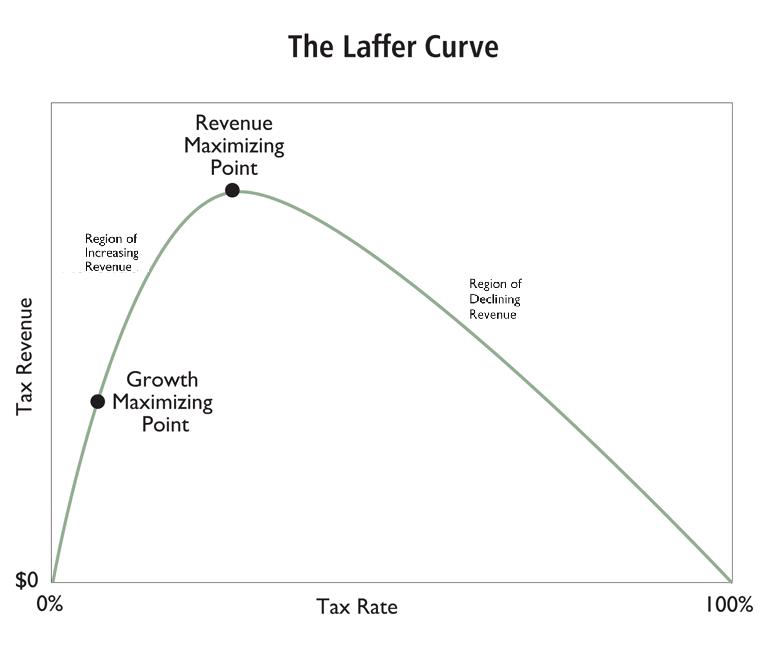

Why do statists support higher tax rates? The most obvious answer is greed. In other words, leftists want more tax money since they personally benefit when there’s a larger burden of government spending. And the greed can take many forms. They may want bigger...

by Dan Mitchell | Jan 2, 2014 | Blogs, Economics, Laffer Curve, Taxation

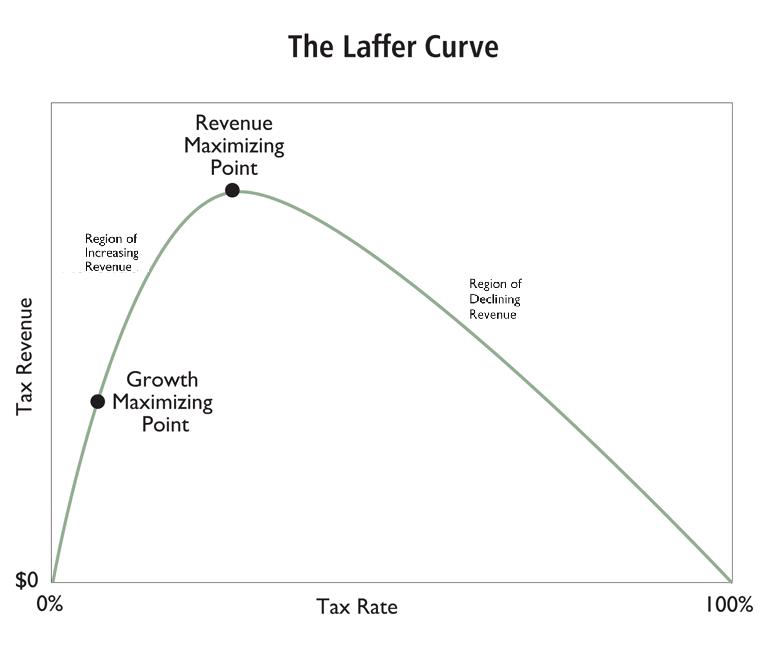

The business pages are reporting that Chrysler will be fully owned by Fiat after that Italian company buys up remaining shares. I don’t know what this means about the long-term viability of Chrysler, but we can say with great confidence that the company will be better...

by Dan Mitchell | Dec 8, 2013 | Blogs, Economics, Taxation

The title of this piece has an asterisk because, unfortunately, we’re not talking about progress on the Laffer Curve in the United States. Even Keynes himself accepted this. Like many other economists throughout the ages, he understood and agreed with the principles...

by Dan Mitchell | Sep 18, 2013 | Big Government, Blogs, Government Spending, Taxation

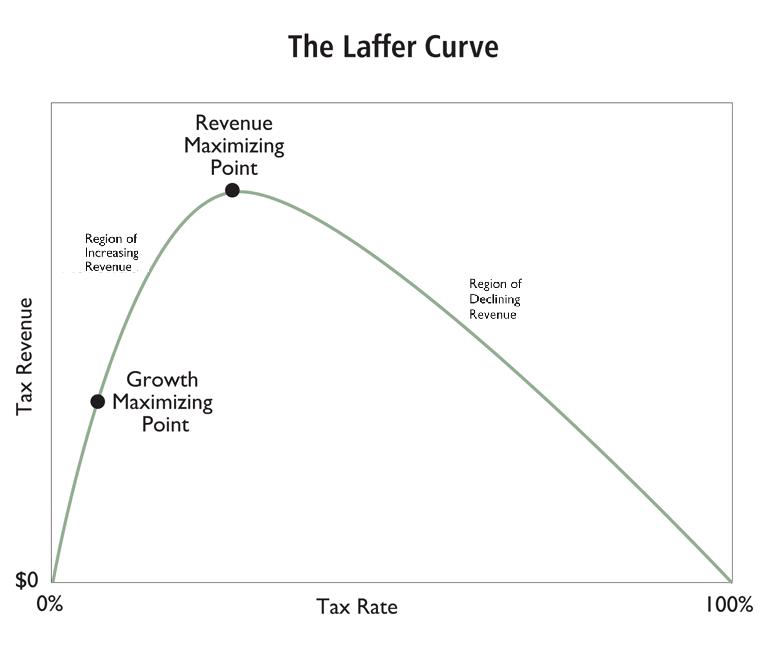

We have an amazing man-bites-dog story today. Let’s begin with some background information. A member of the European Commission recently warned that: “Tax increases imposed by the Socialist-led government in France have reached a “fatal level”…[and] that a series of...