by Dan Mitchell | Dec 15, 2015 | Blogs, Taxation

If you owned a restaurant and wanted to generate more income and boost your bottom line, would you double your prices thinking that this would double your revenue? Of course not. You would understand that a lot of your patrons would simply dine elsewhere. And if they...

by Dan Mitchell | Nov 16, 2015 | Big Government, Blogs, Economics, Government Spending, Supply Side, Taxation

Since I’m a big fan of the Laffer Curve, I’m always interested in real-world examples showing good results when governments reduce marginal tax rates on productive activity. Heck, I’m equally interested in real-world results when governments do the wrong thing and...

by Dan Mitchell | Nov 15, 2015 | Blogs, Economics, Taxation

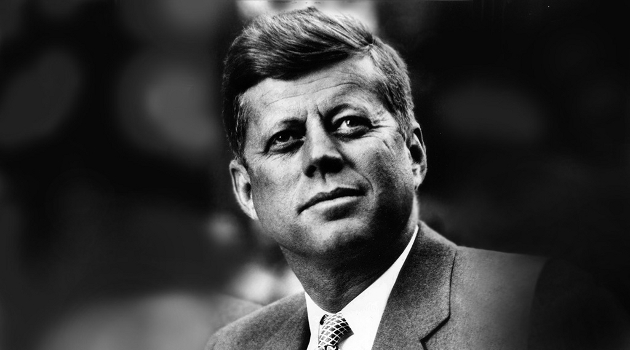

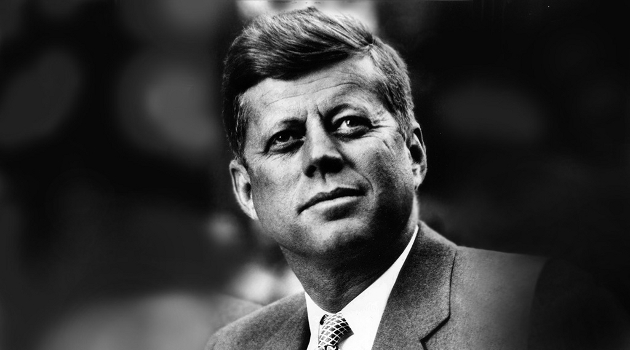

During last night’s Democratic debate, Senator Bernie Sanders said he would not raise tax rates as high as they were in the 1950s. And if Twitter data is accurate, his comment about being “not that much of a socialist compared to [President] Eisenhower” was one of the...

by Dan Mitchell | Oct 20, 2015 | Blogs, Economics, Taxation

More than two years ago, I cited some solid research from the Tax Foundation to debunk some misguided analysis from the New York Times about the taxation of multinational companies. Well, it’s déjà vu all over again, as the late Yogi Berra might say. That’s because we...

by Dan Mitchell | Aug 6, 2015 | Big Government, Blogs, Government Spending, Taxation

I have a very mixed view of the Committee for a Responsible Federal Budget, which is an organization representing self-styled deficit hawks in Washington. They do careful work and I always feel confident about citing their numbers. Yet I frequently get frustrated...