by CF&P | Sep 9, 2015 | News, Prosperity Updates

BEPS News… BEPS Pivotal in Fight Over Tax Competition In Cayman Financial Review, CF&P’s Brian Garst contends, “The OECD wants to turn back the clock and undo the tremendous gains brought about by tax...

by Andrew F. Quinlan | Sep 3, 2015 | Opinion and Commentary

This article originally appeared on The Hill’s Congress Blog on September 2, 2015. The Internal Revenue Service (IRS) has faced intense scrutiny over the past year thanks to the Lois Learner scandal involving the IRS targeting of groups because of their...

by Dan Mitchell | Jul 25, 2015 | Blogs

Remember Sleepless in Seattle, the 1993 romantic comedy starring Tom Hanks and Meg Ryan? Well, there should be a remake of that film entitled Clueless in Washington. But it wouldn’t be romantic and it wouldn’t be a comedy. Though there would be a laughable aspect to...

by Dan Mitchell | Jul 16, 2015 | Blogs, Taxation

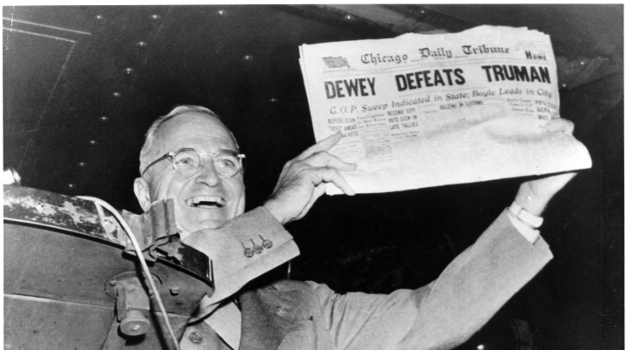

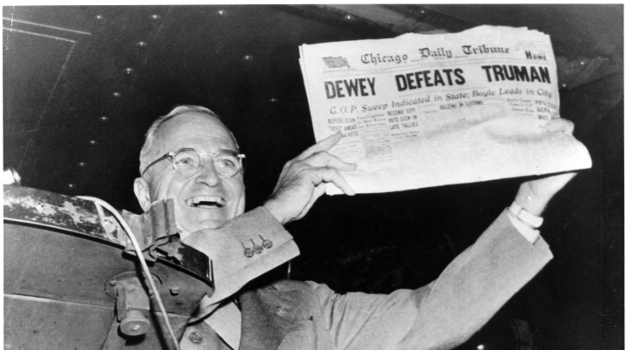

When I wrote about the media, it’s generally to criticize sloppy and/or biased reporting But maybe I need to have a new category that features misleading headlines. For instance, here’s a report by Fox Business News that grabbed my attention because of the headline....

by Brian Garst | Apr 24, 2015 | Opinion and Commentary

This article appeared in Cayman Financial Review on April 22, 2015. After years of upheaval in the financial sector, taxpayer confusion, and widespread international angst, the IRS has finally unveiled its FATCA registration and reporting system. The system is known...