by Dan Mitchell | Apr 15, 2018 | Blogs, Taxation

I’ve been in Prague the past few days for a meeting of the European Resource Bank. I spoke today about a relatively unknown international bureaucracy called the European Bank for Reconstruction and Development and I warned that it is going through a process of...

by Dan Mitchell | Apr 9, 2018 | Big Government, Blogs, Government Spending, Taxation

Five former Democratic appointees to the Council of Economic Advisers have a column in today’s Washington Post asserting that we should not blame entitlements for America’s future fiscal problems. The good news is that they at least recognize that there’s a future...

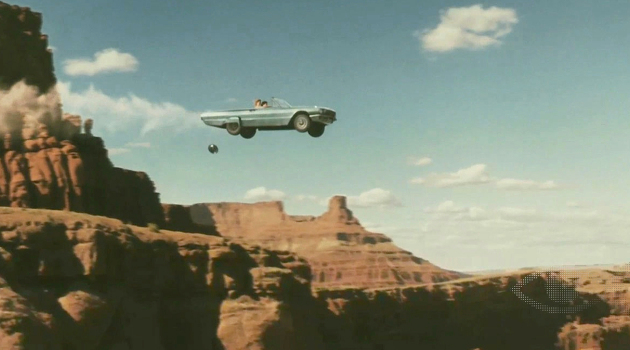

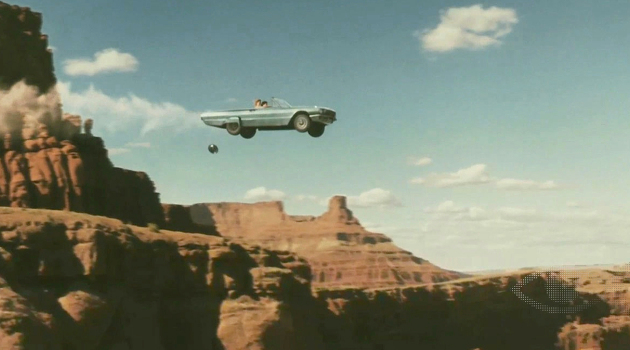

by Dan Mitchell | Apr 6, 2018 | Big Government, Blogs, States, Tax Competition, Taxation

I’m a big fan of federalism because states have the flexibility to choose good policy or bad policy. And that’s good news for me since I get to write about the consequences. One of the main lessons we learn (see here, here, here, here, and here) is that high-earning...

by Dan Mitchell | Mar 25, 2018 | Blogs, Taxation

If you were exempted from taxation, you’d presumably be very happy. After all, even folks on the left do everything they can to minimize their tax payments. Now imagine that you are put in charge of tax policy. Like Elizabeth Warren, you obviously won’t volunteer to...

by Dan Mitchell | Mar 17, 2018 | Blogs, Taxation

A couple of decades can make a huge difference in the political and economic life of a jurisdiction. Two decades ago, Venezuela had not yet been subjected to the horror of Hugo Chavez and his destructive statism. Three decades ago, the pro-market success story of...