by Dan Mitchell | Feb 3, 2020 | Big Government, Blogs, Taxation, Welfare and Entitlements

Assuming he was able to impose his policy agenda, I think Bernie Sanders – at best – would turn America into Greece. In more pessimistic moments, I fear he would turn the U.S. into Venezuela. The Vermont Senator and his supporters say that’s wrong and that the real...

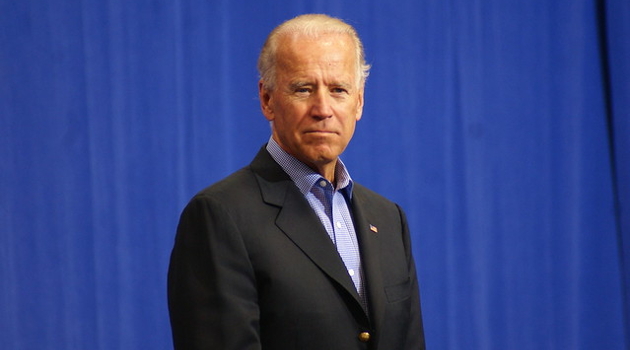

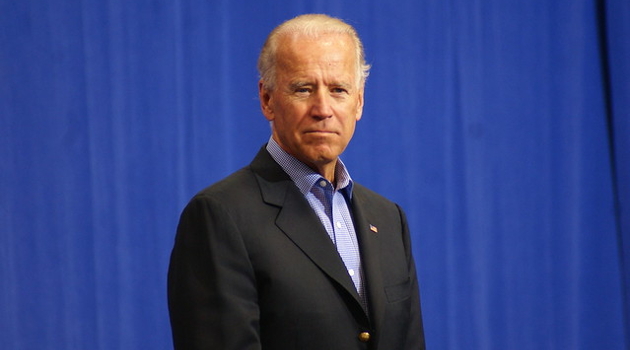

by Dan Mitchell | Jan 22, 2020 | Big Government, Blogs, Government Spending, Taxation

Given their overt statism, I’ve mostly focused on the misguided policies being advocated by Bernie Sanders and Elizabeth Warren. But that doesn’t mean Joe Biden’s platform is reasonable or moderate. Ezra Klein of Vox unabashedly states that the former Vice President’s...

by Dan Mitchell | Jan 3, 2020 | Blogs, Taxation

I want more people to become rich. That’s why I support free markets. But a few already-rich people say such silly things that I wonder whether a big bank account somehow can lead to a loss of common sense. For background information on this issue, there’s...

by Dan Mitchell | Dec 9, 2019 | Big Government, Blogs, Taxation, Welfare and Entitlements

I’m currently in London for discussions about public policy, particularly the potential for the right kind of free-trade pact between the United States and United Kingdom. I deliberately picked this week for my visit so I also could be here for the British...

by Dan Mitchell | Dec 6, 2019 | Big Government, Blogs, Economics, Government Spending, Taxation

Arthur Okun was a well-known left-of-center economist last century. He taught at Yale, was Chairman of the Council of Economic Advisors for President Lyndon Johnson, and also did a stint at Brookings. In today’s column, I’m not going to blame him for any of LBJ’s...