Tag Archives : Government intervention

The Higher-Education Bubble and Third-Party Payer

Taxes and spending are two of the most obvious burdens imposed by government, and I’m glad that many people are fighting against a political class that seems to have a limitless appetite for a bigger public sector. But politicians also can do great damage to an economy with mandates, regulations, and other forms of intervention. […]

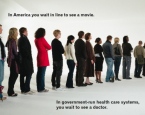

read more...Another Horror Story about Government-Run Healthcare that Can’t Possibly Be True According to Paul Krugman

Paul Krugman has told us that awful stories about government-run healthcare in Britain “are false.” I guess this means that the media must be dominated by conservative liars, since we keep getting reports about substandard care and needless deaths (see here, here, here, here, here, here, here, here, here and here). And the Boston Globe and Associated Press must be part of this vast […]

read more...When Will We Learn that Regulation Is the Problem rather than the Solution?

I’ve explained on many occasions how the financial crisis was largely the result of government-imposed mistakes, and I’ve paid considerable attention to the role of easy money by the Federal Reserve and the perverse subsidies provided by Fannie Mae and Freddie Mac. But I’ve only once touched on the role of the Basel regulations on […]

read more...Despicable and Corrupt Republicans Vote for More Housing Subsidies

Remember my post from a week ago when I said I was not a Republican even though Ronald Reagan and Calvin Coolidge are two of my heroes? Well, now I have another reason to despise the GOP. Those reprehensible statists just voted to expand federal housing subsidies. Here are some excerpts from an excellent National Review column […]

read more...The Deadly Impact of FDA Regulation

I recently commented on some astounding numbers showing that each regulatory bureaucrat destroys 100 jobs in the productive sector of the economy. That’s obviously terrible news. Heck, it would be awful if each bureaucrat caused the destruction of 2 private-sector jobs. But here are some excerpts from a John Stossel column about how the bureaucrats […]

read more...Compulsive Spendaholics: The Unfortunate Similarity of Bush/Obama and Hoover/Roosevelt

I’ve pointed out on several occasions that Herbert Hoover was a big-spending Keynesian. Heck, Hoover was pursuing failed Keynesian policies several years before Keynes produced his most well-known book, The General Theory. Hoover’s big spending was so pronounced that it generated this cartoon in 1932. Sadly, this cartoon applies just as well today. Except Bush […]

read more...If Obama Wants to Create More Jobs, He Should Get Rid of Regulatory Bureaucrats

Last year, I reported on a study from the Small Business Administration that estimated that federal regulation costs the economy a staggering $1.75 trillion every year. But that number is so large that it’s hard to understand what it actually means, so let’s look at some new research to better understand the impact of red […]

read more...Republicans vs. the Free Market

Over and over again, I tell people to ignore whether politicians have a D or an R after their names. That’s because Democrats sometimes do the right thing and Republicans often do the wrong thing. My latest example of Republicans doing the wrong thing come from Florida, where GOP politicians decided that free markets should […]

read more...Should Washington Re-Inflate the Housing Bubble?

I have no idea whether George Santayana was a good philosopher, but he certainly was right when he wrote, “Those who do not learn from history are doomed to repeat it.” Consider the fools in the U.S. Senate. They just voted to expand Fannie Mae and Freddie Mac subsidies, apparently thinking that re-inflating the housing […]

read more...New Video Has Important Message: Freedom and Prosperity vs. Big Government and Stagnation

The folks from the Koch Institute put together a great video a couple of months ago looking at why some nations are rich and others are poor. That video looked at the relationship between economic freedom and various indices that measure quality of life. Not surprisingly, free markets and small government lead to better results. […]

read more...