by Dan Mitchell | May 24, 2021 | Blogs, Tax Competition, Tax Harmonization, Taxation

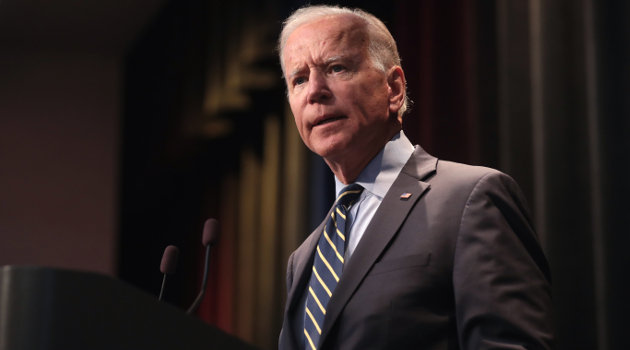

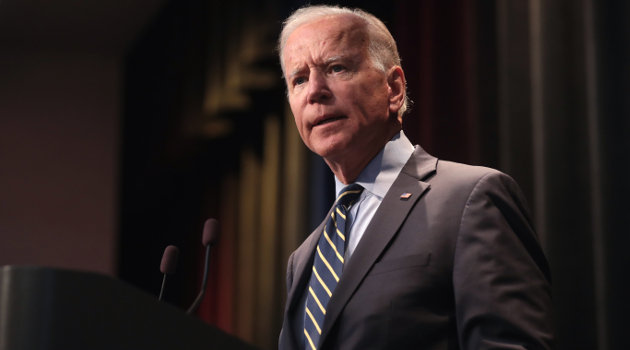

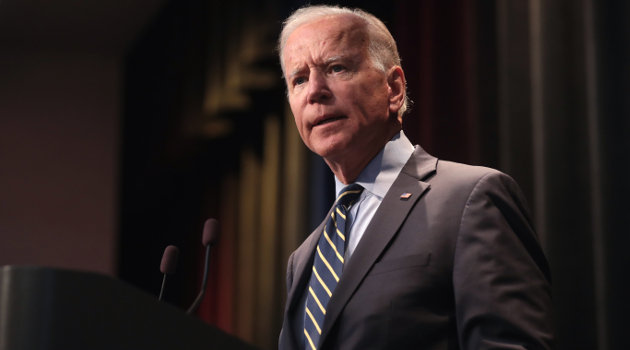

As explained here, here, here, and here, I don’t like Biden’s class-warfare tax policy. I’m especially concerned about his approach to business taxation. He wants to penalize American-based companies with the highest corporate...

by Dan Mitchell | May 21, 2021 | Opinion and Commentary

Originally published by the Orange County Register on May 20, 2021. President Biden has proposed very large tax increases to finance a bigger burden of government spending. Many of those tax increases will be imposed on corporations, and this will be bad news for the...

by Dan Mitchell | Mar 1, 2021 | Blogs, Tax Competition, Taxation, Uncategorized

Last summer, I provided testimony to the United Nations’ High-Level Panel on Financial Accountability Transparency & Integrity. I touched on many issues, but my testimony focused on some core principles of sensible taxation. Low marginal tax...

by Dan Mitchell | Nov 13, 2019 | Blogs, Taxation

Ever since the bureaucrats at the Organization for Economic Cooperation and Development launched their attack on so-called harmful tax competition back in the 1990s, I’ve warned that the goal has been to create a global tax cartel. Sort of an “OPEC for politicians.”...

by Dan Mitchell | Oct 12, 2019 | Blogs, Energy, Taxation

I’m not a big fan of the International Monetary Fund for the simple reason that the international bureaucracy undermines global prosperity by pushing for higher taxes, while also exacerbating moral hazard by providing bailouts to rich investors who foolishly lend...