by Dan Mitchell | Mar 17, 2022 | Big Government, Blogs, Economics, Free Market, Government Spending

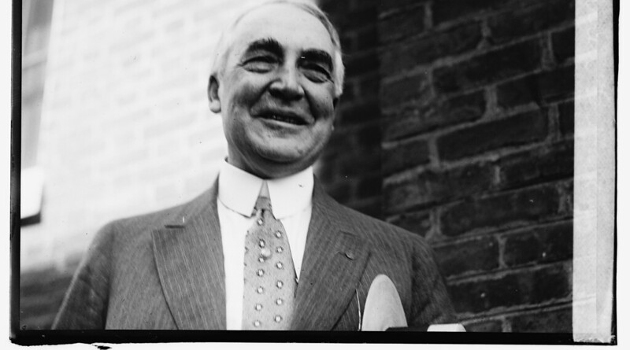

I’ve written about President Warren Harding’s under-appreciated economic policies. He restored economic prosperity in the 1920s by slashing tax rates and reducing the burden of government spending. I’ve also written many...

by Dan Mitchell | Feb 24, 2022 | Blogs, Economics, Free Market, Socialism

For most of human history, we’ve had primitive and impoverished societies based on feudalism and tribalism. The good news is that capitalism began to emerge a couple of hundred years. The parts of the world that adopted free enterprise...

by Dan Mitchell | Feb 21, 2022 | Big Government, Blogs, Free Market, Regulations

While specific examples can be very complex, the economic analysis of regulation is, at least in theory, quite simple. Rules and red tape impose burdens that hinder economic activity, and this leads to higher costs for businesses and consumers. These higher...

by Dan Mitchell | Feb 16, 2022 | Blogs, Free Market

When I first wrote about the Index of Economic Freedom back in 2010, the United States was comfortably among the world’s 10-freest nations with a score of 78 out of 100. By last year, America had dropped to #20, with a very mediocre score of 74.8....

by Dan Mitchell | Jan 30, 2022 | Blogs, Economics, Free Market

I only share long videos when they satisfy key criteria, such as being very informative and very educational. This video from Arthur Brooks is both. What I like most is that he does a very good job of showing that concern for the disadvantaged is the...