by Dan Mitchell | Feb 17, 2016 | Blogs, Economics, Flat Tax, Taxation

I’m in Hong Kong for series of meeting and briefings on various economic and policy issues. As you can imagine, I’m a huge fan of the jurisdiction’s simple 15 percent flat tax. It’s basically about as close to a pure flat tax as anyplace in the world. There is...

by Dan Mitchell | Jan 6, 2016 | Blogs, Flat Tax, Taxation

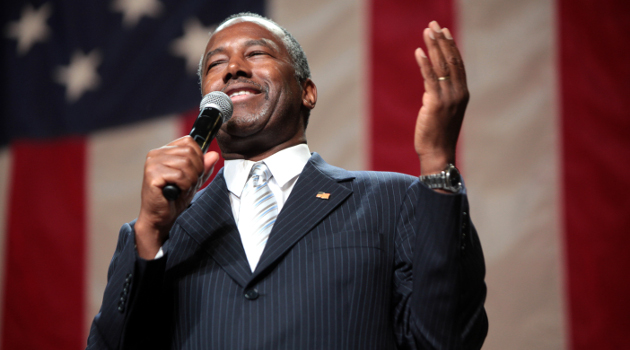

When I compared the tax reform proposals of various 2016 presidential candidates last month, Ben Carson got the best grade by a slight margin. But I’ve now decided to boost his overall grade from a B+ to A-, or perhaps even A, because he’s finally released details and...

by Dan Mitchell | Dec 7, 2015 | Blogs, Economics, Taxation

With all of the GOP presidential candidates proposing varying plans to reduce the tax burden and reform the tax system, I’m constantly asked which one is best. But that’s hard to answer because all of the proposals have features I like…as well as some features that...

by Dan Mitchell | Nov 30, 2015 | Blogs, Taxation

Why does the tax code require more than 10,000,000 words and more than 75,000 pages? There are several reasons and none of them are good. But if you had to pick one cause for all the mess, it would be the fact that politicians have worked with interest groups and...

by Dan Mitchell | Oct 31, 2015 | Blogs, Economics, Taxation

Last year, I wrote a column for the Wall Street Journal making the case that families would benefit more from lower tax rates rather than targeted tax credits. My argument was simple and straightforward. Child-based tax cuts are an effective way of giving targeted...