by Dan Mitchell | Oct 21, 2019 | Blogs, Economics, Taxation

California is suffering a slow but steady decline. Bad economic policy has made the Golden State less attractive for entrepreneurs, investors, and business owners. Punitive tax laws deserve much of the blame, particularly the 2012 decision to impose a top tax rate of...

by Dan Mitchell | Oct 19, 2019 | Blogs, Economics, Free Market

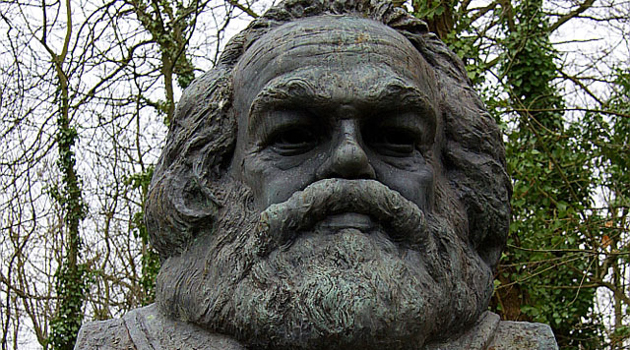

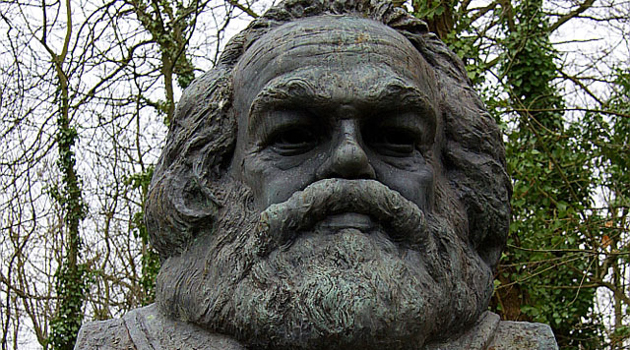

John Papola has done it again. His video showing a Keynes v. Hayek rap contest was superb, and was followed by an equally enjoyable sequel featuring a boxing match between Keynes and Hayek. Now he has a rap contest about capitalism and socialism featuring Ludwig von...

by Dan Mitchell | Oct 18, 2019 | Blogs, Economics

There’s an entire field of economics called “public choice” that analyzes the (largely perverse) incentive structures of politicians and bureaucrats. But is economic analysis also helpful to understand voting and elections? In the past, I’ve suggested that political...

by Dan Mitchell | Oct 15, 2019 | Blogs, Economics

Last year, I wrote a column that investigated why the left is fixated on the unequal distribution of income and wealth, yet doesn’t seem to care at all about unequal distribution of attractiveness. The question becomes even more intriguing when you consider that...

by Dan Mitchell | Oct 10, 2019 | Blogs, Economics, Supply Side, Taxation

In addition to being a contest over expanding the burden of government spending, the Democratic primary also is a contest to see who wants the biggest tax increases. Bernie Sanders and Elizabeth Warren have made class-warfare taxation an integral part of their...