by Dan Mitchell | Apr 6, 2019 | Blogs, Economics, Keynesian, Monetary Policy

Being a policy wonk in a political town isn’t easy. I care about economic liberty while many other people simply care about political maneuvering. And the gap between policy advocacy and personality politics has become even larger in the Age of Trump. One result is...

by Dan Mitchell | Apr 1, 2019 | Blogs, Economics, Monetary Policy

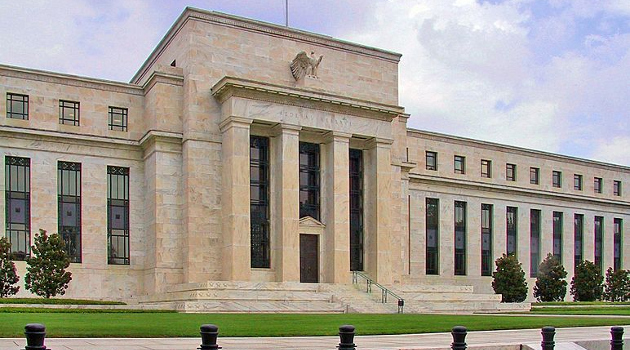

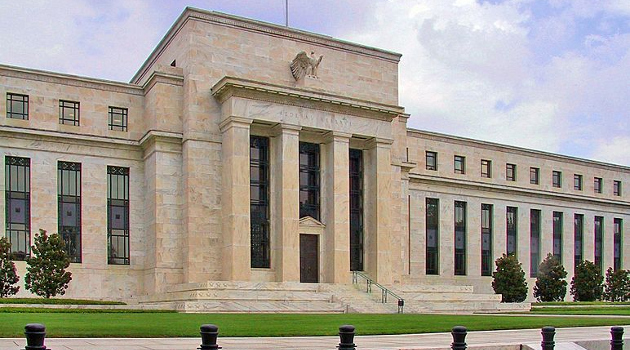

Back in January, I spoke with Cheddar about market instability and put much of the blame on the Federal Reserve. Simply stated, I fear we have a bubble thanks to years and years (and years and years) of easy money and artificially low interest rates. To be sure,...

by Dan Mitchell | Dec 28, 2018 | Big Government, Blogs, Economics, Government Spending

In this interview yesterday, I noted that there are “external” risks to the economy, most notably the spillover effect of a potential economic implosion in China or a fiscal crisis in Italy. But many of the risks are homegrown, such as Trump’s self-destructive...

by Dan Mitchell | Oct 14, 2018 | Blogs, Economics

I periodically explain that you generally don’t get a recession by hiking taxes, adding red tape, or increasing the burden of government spending. Those policies are misguided, to be sure, but they mostly erode the economy’s long-run potential growth. If you want to...

by Dan Mitchell | Aug 8, 2018 | Blogs, Economics

I often discuss the importance of long-run growth and I pontificate endlessly about the policies that will produce better economic performance. But what about short-term fluctuations? Where are we in the so-called business cycle? I don’t think economists are good at...