Tag Archives : Double Taxation

More Double Taxation of Dividends and Capital Gains Would Turn Tax Reform into Tax Deform

Even though I’m a big fan of tax reform, I explained back in June that I’m not very comfortable with the “blank slate” tax reform plan put forth by Senators Max Baucus (D-MT) and Orrin Hatch (R-UT). My main gripe is that they start with the assumption that there should be more double taxation of […]

read more...CBO’s Tax Expenditure Report Uses Wrong Benchmark, Overstates Loopholes

As a long-time advocate of tax reform, I’m not a fan of distortionary loopholes in the tax code. Ideally, we would junk the 74,000-page internal revenue code and replace it with a simple and fair flat tax – meaning one low rate, no double taxation, and no favoritism.* The right kind of tax reform would […]

read more...New CF&P “Economics 101” Video Blasts Obama’s Class Warfare Tax Policy

The Center for Freedom and Prosperity Foundation (CF&P) released today its latest “Economics 101” video, which analyzes the President’s divisive approach to tax policy. Entitled, “Obamanomics: Class Warfare vs Pro-Growth Tax Policy,” the video explains what’s wrong with the President’s approach and offers a pro-growth alternative.

read more...Obamanomics: Class Warfare vs Pro-Growth Tax Policy

Even though he promised to bring Americans together, President Obama has used class-warfare tax policy to persecute and demonize successful entrepreneurs and investors. This mini-documentary from the Center for Freedom and Prosperity Foundation explains why the tax code shouldn’t be used for anything other than fairly and neutrally collecting a minimum amount of revenue to fund the legitimate functions of the federal government.

read more...A Primer on the Flat Tax and Fundamental Tax Reform

In previous posts, I put together tutorials on the Laffer Curve, tax competition, and the economics of government spending. Today, we’re going to look at the issue of tax reform. The focus will be the flat tax, but this analysis applies equally to national sales tax systems such as the Fair Tax. There are three […]

read more...America’s Olympic Athletes Should Be Taxed on Their Winnings (but Not by the IRS)

My friends at Americans for Tax Reform have received a bunch of attention for a new report entitled “Win Olympic Gold, Pay the IRS.” In this clever document, they reveal that athletes could face a tax bill – to those wonderful folks at the IRS – of nearly $9,000 thanks to America’s unfriendly worldwide tax […]

read more...On Death Tax, the U.S. Is Worse than Greece, Worse than France, and Even Worse than Venezuela

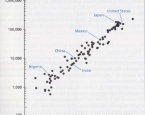

Considering that every economic theory agrees that living standards and worker compensation are closely correlated with the amount of capital in an economy (this picture is a compelling illustration of the relationship), one would think that politicians – particularly those who say they want to improve wages – would be very anxious not to create […]

read more...What Obama and the New York Times Don’t Understand about Worldwide Taxation

Mitt Romney is being criticized for supporting “territorial taxation,” which is the common-sense notion that each nation gets to control the taxation of economic activity inside its borders. While promoting his own class-warfare agenda, President Obama recently condemned Romney’s approach. His views, unsurprisingly, were echoed in a New York Times editorial. President Obama raised…his proposals […]

read more...A Rare Bit of Good News from Europe

It seems that there’s nothing but bad news coming from Europe. Whether we’re talking about fake austerity in the United Kingdom, confiscatory tax schemes in France, or bailouts in Greece, the continent seems to be a case study of failed statism. But that’s not completely accurate. Every so often I highlight good news, such as […]

read more...If You Want To Understand Why Obama’s Tax Agenda Is Bad for Workers, this Picture Says a Thousand Words

A good tax system (like the flat tax) does not impose extra layers of tax on income that is saved and invested. I’ve tried to emphasize this point with a flowchart, and I’ve defended so-called trickle-down economics, which is nothing more than the common-sense notion that investment boosts wages for workers by making them more […]

read more...