Tag Archives : Double Taxation

Debunking VAT Myths

Posted on April 21, 2016

Even normally rational people have bought into some VAT myths.

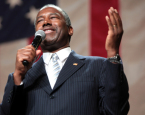

read more...With a Bold and Pure Flat Tax, Ben Carson Sets the Standard for Pro-Growth Reform

Posted on January 6, 2016

With new details, his overall tax plan grade gets a boost.

read more...Debunking Fiscal Myths: There Is No Loophole for “Carried Interest”

Posted on November 10, 2015

If you’ve been following the presidential campaign, you’ll be aware that there’s a controversy over something called “carried interest.”

read more...It’s Time for 2016 Candidates to Unveil Plans to Restrain Spending

Posted on October 1, 2015

For their tax reform plans to work, candidates need concomitant proposals to restrain the growth of federal spending.

read more...Fiscal Fights with Friends, Part II: Grading AEI’s Big-Picture Tax and Budget Reform

Posted on May 21, 2015

Finding the good and the bad in AEI’s plan.

read more...Fiscal Fights with Friends, Part I: Responding to Reihan Salam’s Argument against the Flat Tax

Posted on May 20, 2015

Friendly fire hits the flat tax.

read more...Tax Policy, Double Taxation, Tax Reform, and the Proper Definition of Income

Posted on April 14, 2015

Low rates are great, but it’s equally important to have a system that taxes economic activity only one time.

read more...Grading the Rubio-Lee Tax Reform Plan

Posted on March 4, 2015

How does their plan stack up against these criteria for good tax reform?

read more...If We Care About the Less Fortunate, Focus on Growth Rather Than Redistribution

Posted on February 11, 2015

Politicians and their allies are making life harder for workers.

read more...