Tag Archives : Dividend Taxation

A Primer on Dividend Taxation

An unfair and counterproductive double tax

read more...A Big Benefit of Real Tax Reform Is Ending the Bias for Debt over Equity

Debt and equity should be on a level playing field.

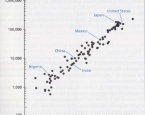

read more...If You Want To Understand Why Obama’s Tax Agenda Is Bad for Workers, this Picture Says a Thousand Words

A good tax system (like the flat tax) does not impose extra layers of tax on income that is saved and invested. I’ve tried to emphasize this point with a flowchart, and I’ve defended so-called trickle-down economics, which is nothing more than the common-sense notion that investment boosts wages for workers by making them more […]

read more...How Can Obama Look at these Two Charts and Conclude that America Should Have Higher Double Taxation of Dividends and Capital Gains?

As discussed yesterday, the most important number in Obama’s budget is that the burden of government spending will be at least $2 trillion higher in 10 years if the President’s plan is enacted. But there are also some very unsightly warts in the revenue portion of the President’s budget. Americans for Tax Reform has a […]

read more...Debating at U.S. News & World Report, I Explain Double Taxation to the Economic Heathens

Never let it be said I back down from a fight, even when it’s the other team’s game, played by the other team’s rules, and for the benefit of the wrong person. And that definitely went through my mind when U.S. News & World Report asked me to contribute to their “Debate Club” on the […]

read more...Explaining the Perverse Impact of Double Taxation with a Chart

Whether I’m criticizing Warren Buffett’s innumeracy or explaining how to identify illegitimate loopholes, I frequently write about the perverse impact of double taxation. By this, I mean the tendency of politicians to impose multiple layers of taxation on income that is saved and invested. Examples of this self-destructive practice include the death tax, the capital […]

read more...