by Dan Mitchell | Dec 6, 2021 | Big Government, Blogs, Economics, Government Spending, Taxation

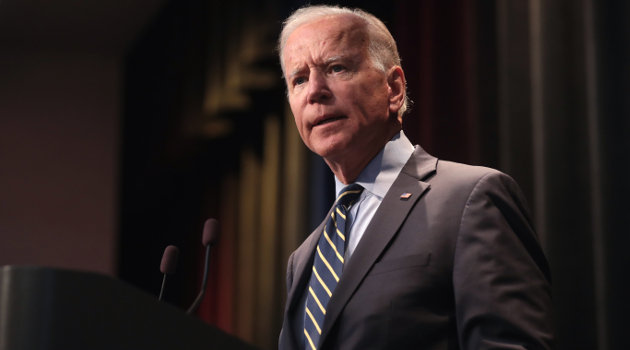

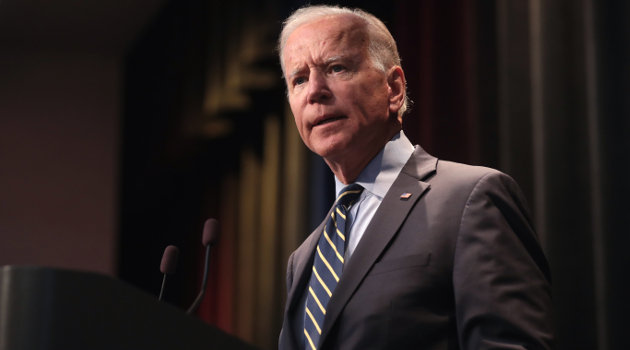

Regarding fiscal policy, almost everyone’s attention is focused on Biden’s growth-sapping plan to increase the burden of taxes and spending. People are right to be concerned. If the President’s plan is approved, the already-grim fiscal outlook for...

by Dan Mitchell | Sep 28, 2021 | Big Government, Blogs, Government Spending

Last week, I wrote about a new study which estimates that Biden’s fiscal agenda of bigger government and higher taxes would reduce economic output by about $3 trillion over the next decade. Perhaps more relevant, that foregone economic...

by Dan Mitchell | Jul 28, 2021 | Big Government, Blogs, Government Spending, Taxation

Back in 2019, I listed “Six Principles to Guide Policy on Government Spending.” If I was required to put it all in one sentence (sort of), here’s the most important thing to understand about fiscal policy. This does not mean, by the way, that we should...

by Dan Mitchell | Feb 15, 2021 | Big Government, Blogs, Government Spending, Taxation

The 21st century has been bad news for proponents of limited government. Bush was a big spender, Obama was a big spender, Trump was a big spender, and now Biden also wants to buy votes with other people’s money. That’s the bad news. The good news...

by Dan Mitchell | Jan 23, 2021 | Big Government, Blogs, Government Spending

I have relentlessly criticized Republicans in recent years for being profligate big spenders. But I have some good news. The GOP is finding religion and is once again fretting about big government. The bad news is that many of them are total...