by Dan Mitchell | Nov 18, 2015 | Big Government, Blogs

Washington is a horribly corrupt city. The tax code is riddled with special favors for politically powerful interest groups. The budget is filled with handouts and subsidies for well-connected insiders. The regulatory apparatus is a playground for cronyism. I’ve...

by Dan Mitchell | Nov 5, 2015 | Big Government, Blogs, Government Spending, Government Waste

Yesterday, I shared several stories that exposed the festering corruption of Washington. Today, let’s look at one issue that symbolizes the pervasive waste of Washington. Medicare is the federal government’s one-size-fits-all health program for the elderly. Because of...

by Andrew F. Quinlan | Nov 4, 2015 | Opinion and Commentary

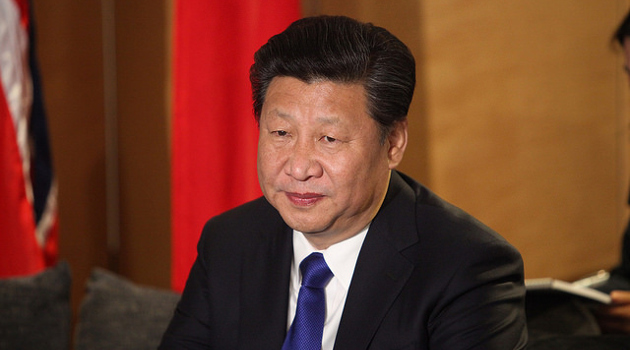

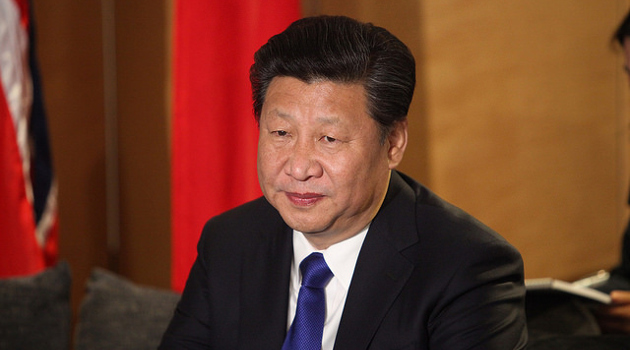

This article appeared on The Blaze on November 2, 2015. Chinese President Xi Jinping’s public crackdown on corruption has captivated Western media, leading to sensational stories like recent reports that golf club membership is among the newly announced list of...

by Dan Mitchell | Nov 4, 2015 | Big Government, Blogs

I’ve explained, over and over and over again, that big government is the mother’s milk of corruption. Simply stated, a convoluted tax code, bloated budget, and regulatory morass create endless opportunities for well-connected insiders to obtain unearned and undeserved...

by Dan Mitchell | Oct 3, 2015 | Big Government, Blogs

Back in March, I asked why Republican presidential candidates were willing to openly violate federal anti-bribery law by supporting agriculture subsidies in exchange for campaign loot. My question was merely rhetorical, of course, since politician supposedly aren’t...