by Dan Mitchell | Jun 25, 2021 | Tax Competition, Tax Harmonization, Taxation

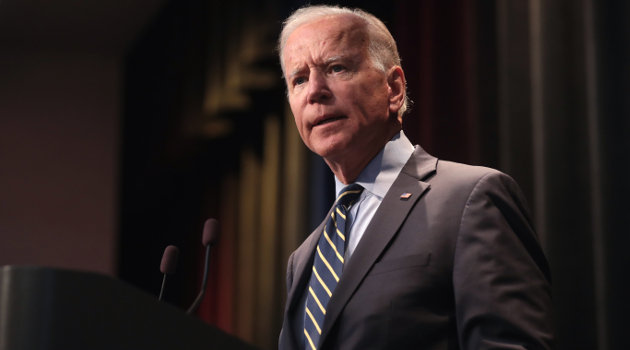

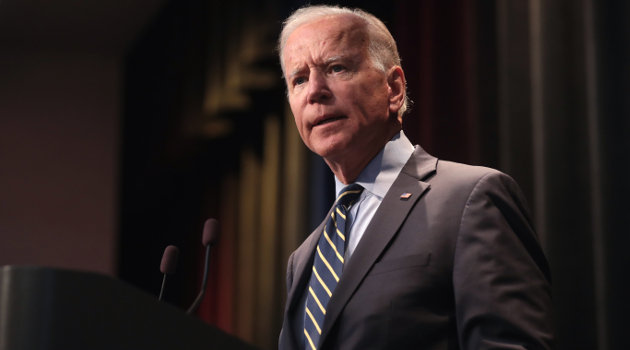

Yesterday’s column explained why Biden’s proposed global cartel for corporate taxation was a bad idea. In this clip from a recent panel hosted by the Austrian Economics Center in Vienna, I speculated on whether the plan would become reality. I encourage you to watch...

by Dan Mitchell | Jun 24, 2021 | Blogs, Tax Competition, Taxation

When governments have to compete with each other, we get lower tax rates. That’s good for taxpayers and good for growth. But politicians hate limits on their taxing power, which is why Biden has proposed a global tax cartel. Here are some of my remarks made yesterday...

by Dan Mitchell | Jun 6, 2021 | Blogs, Tax Competition, Tax Harmonization, Taxation

Biden’s tax agenda – especially the proposed increase in the corporate rate – would be very bad for American competitiveness. We know this is true because the Administration wants to violate the sovereignty of other nations with a...

by Dan Mitchell | Jun 1, 2021 | Big Government, Blogs, Government Spending

In the world of public finance, Ireland is best known for its 12.5 percent corporate tax rate. That’s a very admirable policy, as will be momentarily discussed, but my favorite Irish policy was the four-year spending freeze in the late 1980s....

by Dan Mitchell | May 24, 2021 | Blogs, Tax Competition, Tax Harmonization, Taxation

As explained here, here, here, and here, I don’t like Biden’s class-warfare tax policy. I’m especially concerned about his approach to business taxation. He wants to penalize American-based companies with the highest corporate...