by Dan Mitchell | Jul 26, 2017 | Big Government, Blogs, Economics

Canada is now one of the world’s most economically free nations thanks to relatively sensible policies involving spending restraint, corporate tax reform, bank bailouts, regulatory budgeting, the tax treatment of saving, and privatization of air traffic control. Heck,...

by Dan Mitchell | Jul 8, 2017 | Big Government, Blogs, States, Taxation

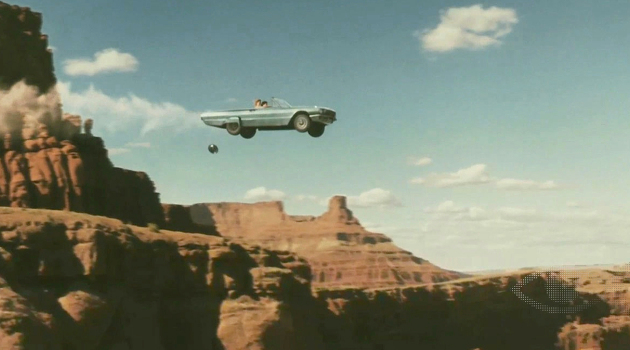

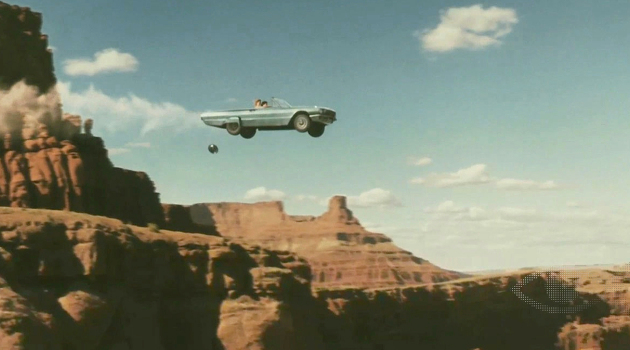

Here’s what I wrote last month about the fiscal situation in Illinois. Illinois is a mess. Taxes and spending already are too high, and huge unfunded liabilities point to an even darker future. Simply stated, politicians and government employee unions have created an...

by Dan Mitchell | Jun 3, 2017 | Blogs, Economics, Taxation

Illinois is a mess. Taxes and spending already are too high, and huge unfunded liabilities point to an even darker future. Simply stated, politicians and government employee unions have created an unholy alliance to extract as much money as possible from the state’s...

by Dan Mitchell | May 25, 2017 | Blogs, Economics, Tax Competition, Taxation

What’s the best argument for reducing the onerous 35 percent corporate tax rate in the United States? 1. Should the rate be lowered because it’s embarrassing that America has the highest corporate tax rate in the developed world, and perhaps the entire world? That’s...

by Dan Mitchell | May 9, 2017 | Blogs, Economics

Earlier today, I gave a speech about populism and capitalism at the Free Market Road Show in Thessaloniki, Greece. But I’m not writing about my speech (read this and this if you want to get an idea of what I said about American policy under Trump). Instead, I want to...