Tag Archives : Class Warfare

If You Want To Understand Why Obama’s Tax Agenda Is Bad for Workers, this Picture Says a Thousand Words

A good tax system (like the flat tax) does not impose extra layers of tax on income that is saved and invested. I’ve tried to emphasize this point with a flowchart, and I’ve defended so-called trickle-down economics, which is nothing more than the common-sense notion that investment boosts wages for workers by making them more […]

read more...Explaining in the New York Post Why Obama’s Soak-the-Rich Tax Policy Is Doomed to Failure

I think high tax rates on certain classes of citizens are immoral and discriminatory. If the government is going to collect revenue, all taxpayers should be treated equally, with something akin to a simple flat tax. But most people don’t seem to care about having the law apply the same to all people, so I […]

read more...The Right Capital Gains Tax Rate Is Zero

The silly debate about the “Buffett Rule” is really an argument about the extent to which there should be more double taxation of income that is saved and invested. Politicians conveniently forget that dividends and capital gains get hit by the corporate income tax. And since America now has the developed world’s highest corporate income […]

read more...Senator Ron Johnson Exposes Obama’s “Frugal Budget”

I mentioned yesterday that Senator Johnson of Wisconsin did a good job at the Senate Budget Committee’s hearing on tax reform. Today, I want to elaborate on two of his points. First, he asked all three of the witnesses what the maximum marginal tax rate on any American should be. The two leftists on the […]

read more...To Boost Obama’s Redistribution Agenda, OECD Pushes Crazy Assertion that Poverty Is Higher in the U.S. than in Greece, Hungary, Portugal, and Turkey

Supporters of individual liberty and national sovereignty have been skeptical of the United Nations, and with good reason. With the support of statists such as George Soros, the U.N. pushes for crazy ideas such as global taxation and global currency. But there’s another international bureaucracy, also funded by American tax dollars, that is even more […]

read more...If Even the International Monetary Fund Acknowledges the Laffer Curve, Why Doesn’t Obama Realize that Higher Tax Rates are All Pain and No Gain?

I speculated last year that the political elite finally might be realizing that higher tax rates are not the solution to Greece’s fiscal situation. Simply stated, you can only squeeze so much blood out of a stone, and pushing tax rates higher cripples growth and drives more people into the underground economy. Well, it turns […]

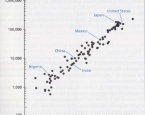

read more...How Can Obama Look at these Two Charts and Conclude that America Should Have Higher Double Taxation of Dividends and Capital Gains?

As discussed yesterday, the most important number in Obama’s budget is that the burden of government spending will be at least $2 trillion higher in 10 years if the President’s plan is enacted. But there are also some very unsightly warts in the revenue portion of the President’s budget. Americans for Tax Reform has a […]

read more...Is Warren Buffett’s Support for Higher Taxes a Way of Paying Back Politicians for Big-Government Policies that Line His Pockets?

President Obama, echoed by the establishment media, routinely trumpets Warren Buffett’s support for higher taxes. If this rich guy is willing to pay more, the story goes, then surely the rest of us peasants should just roll over and acquiesce to the President’s class-warfare tax policy. Well, one reason we shouldn’t surrender is that Buffett […]

read more...Don Boudreaux Debunks Robert Reich

I’ve debated Robert Reich on issues such as tax havens, class warfare, and oil companies. Those interactions apparently aren’t enough, though, since several people have asked me to debunk this Reich video. But I had no desire to address Reich’s demagoguery, in part because I’ve already put together videos that deal with most of his […]

read more...Debating at U.S. News & World Report, I Explain Double Taxation to the Economic Heathens

Never let it be said I back down from a fight, even when it’s the other team’s game, played by the other team’s rules, and for the benefit of the wrong person. And that definitely went through my mind when U.S. News & World Report asked me to contribute to their “Debate Club” on the […]

read more...