Tag Archives : Class Warfare

The New York Times Calls (again) for Higher Taxes on Middle-Class Americans

ll statists want much bigger government, but not all of them are honest about how to finance a Greek-sized welfare state. The President, for instance, wants us to believe that the rich are some sort of fiscal pinata, capable of generating endless amounts of tax revenue. Using IRS tax data, I’ve shown that this is […]

read more...Grilled about Cayman Investments, Jack Lew Chooses the I’m-a-Moron Defense

Every so often, you get a “teaching moment” in Washington, and we now have an excellent opportunity to educate lawmakers about the “offshore” world because President Obama’s nominee to be Treasury Secretary has been caught with his hand in the tax haven cookie jar. Mr. Lew not only invested some of his own money in […]

read more...Rather than Helping the Poor, Higher Tax Rates Redistribute Rich People

Daniel Hannan is a member of the European Parliament from England. He is one of the few economically sensible people in that body, as demonstrated in these short clips of him speaking about tax competition and deriding the European Commission’s corrupt racket. And as you can see from his latest article in the UK-based Telegraph, […]

read more...Based on a Review of Studies Looking at the Impact of Taxes on Growth, Academic Research Gives Obama a Record of 0-23-3

How do you define a terrible team? No, this isn’t going to be a joke about Notre Dame foolishly thinking it could match up against a team from the Southeastern Conference in college football’s national title game (though the Irish win the contest for prettiest make-believe girlfriends). I’m asking the question because a winless record […]

read more...The Basket Case Sometimes Known as Japan

Good fiscal policy doesn’t require heavy lifting. Governments simply need to limit the burden of government spending. The key variable is making sure spending doesn’t consume ever-larger shares of economic output. In other words, follow Mitchell’s Golden Rule. It’s possible for a nation to have a large public sector and be fiscally stable. Growth won’t […]

read more...The Only Good Death Tax is a Dead Death Tax

Just before the end of the year, I shared some fascinating research about people dying quicker or living longer when there are changes in the death tax. Sort of the ultimate Laffer Curve response, particularly if it’s the former. But the more serious point is that the death tax shouldn’t exist at all, as I’ve […]

read more...Class Warfare Tax Policy Causes Portugal to Crash on the Laffer Curve, but Will Obama Learn from this Mistake?

Back in mid-2010, I wrote that Portugal was going to exacerbate its fiscal problems by raising taxes. Needless to say, I was right. Not that this required any special insight. After all, no nation has ever taxed its way to prosperity. We’re now at the end of 2012 and Portugal is still saddled with a […]

read more...Once Obama’s Policies Are Implemented Next Year, U.S. Capital Gains Tax Rate Will be 70 percent Higher than Global Average

Back in September, I shared a very good primer on the capital gains tax from the folks at the Wall Street Journal, which explained why this form of double taxation is so destructive. I also posted some very good analysis from John Goodman about the issue. Unfortunately, even though the United States already has a […]

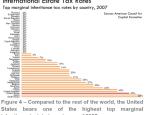

read more...Obama’s Deadly Plan for the Death Tax

In some ways, it would be fun to be a leftist. No, I’m not talking about living a life of idleness and letting others pay my bills, though I suppose that’s tempting to some people. And I’m not talking about becoming a Washington insider and using corrupt connections to obtain unearned wealth, though I confess […]

read more...The Continuing Exodus of Jobs – and Taxable Income – from California

Like most people, I’m a sucker for a heartwarming story around the holidays. Sometimes, you get that nice feeling when good things happen to good people, like you find at the end of a classic movie like “It’s a Wonderful Life.” But since I’m a bit of a curmudgeon, I also feel all warm and […]

read more...