Tag Archives : Class Warfare

Income Inequality and Guilt-Ridden Leftists

Our leftist friends have decided that income inequality is a scourge that must be addressed. That might be a noble goal if they were motivated by a desire to improve the lives of the less fortunate. Based on their policy proposals, though, it appears that the main goal is to punish the so-called rich. And they’re so fixated […]

read more...Be Thankful for Capitalism and Rich Entrepreneurs

In previous columns, I’ve explained why a wealth tax is a very bad idea. And I’ve also pontificated on why leftists are wrong to pursue policies of coerced equality. So it goes without saying that I’m a big fan of a new Wall Street Journal column by John Steele Gordon. He writes that the anti-wealth ideology animating the political elite is based on a fundamental […]

read more...Will Chile’s Politicians Ruin the Latin Tiger?

here aren’t any nations with pure libertarian economic policy, but there are a handful of jurisdictions that deserve praise, either because they have comparatively low levels of statism or because they have made big strides in the right direction. Hong Kong and Singapore are examples of the former, and Switzerland deserves honorable mention. And if we look at […]

read more...A Taxapalooza: More Taxpayer-Subsidized Agitation for Class Warfare by the OECD

I’ve already written about how the Paris-based Organization for Economic Cooperation and Development (OECD), which is heavily subsidized by American taxpayers, is advocating for bigger government. I’m especially irked that the OECD has gotten in bed with nutjobs from the Occupy movement and also joined forces with the union bosses to push for statist policies. So I guess I shouldn’t […]

read more...Obama’s New Budget: Burden of Government Spending Rises More than Twice as Fast as Inflation

The President’s new budget has been unveiled. There are lots of provisions that deserve detailed attention, but I always look first at the overall trends. Most specifically, I want to see what’s happening with the burden of government spending. And you probably won’t be surprised to see that Obama isn’t imposing any fiscal restraint. He wants spending to […]

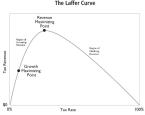

read more...A Primer on the Laffer Curve to Help Understand Why Obama’s Class-Warfare Tax Policy Won’t Work

My main goal for fiscal policy is shrinking the size and scope of the federal government and lowering the burden of government spending. But I’m also motivated by a desire for better tax policy, which means lower tax rates, less double taxation, and fewer corrupting loopholes and other distortions. One of the big obstacles to good tax policy is that many statists […]

read more...What Motivates the Left, Envy or Greed?

Why do statists support higher tax rates? The most obvious answer is greed. In other words, leftists want more tax money since they personally benefit when there’s a larger burden of government spending. And the greed can take many forms. They may want bigger government because they’re welfare recipients getting handouts. They may want bigger government because […]

read more...Everything You Ever Needed to Know about the Left’s View of Income Inequality, Captured in a Single Image

If you want to know why the left is wrong about income inequality, you need to watch this Margaret Thatcher video. In just a few minutes, the “Iron Lady” explains how some – perhaps most – statists would be willing to reduce income for the poor if they could impose even greater damage on the rich. […]

read more...Massive Double Taxation Is a Self-Inflicted Tax Injury that Undermines American Competitiveness and Job Creation

Back in the 1960s, Clint Eastwood starred in a movie entitled The Good, the Bad and the Ugly. I was thinking that might be a good title for today’s post about some new research by Michelle Harding, a tax economist for the OECD. But then I realized that her study on “Taxation of Dividend, Interest, […]

read more...New York City Is About to Become New France

We know that countries suffer when taxes get too high, in part because investors, entrepreneurs, and other successful taxpayers escape to jurisdiction with less oppressive fiscal regimes. France is a glaring example. On steroids. We know that states also suffer when the tax burden becomes too onerous, leading to an exodus of jobs and investment. […]

read more...