by Dan Mitchell | Oct 11, 2018 | Blogs

I’m not a big fan of the International Monetary Fund and I regularly criticize the international bureaucracy for its relentless advocacy in favor of higher taxes. But that’s not what worries me most about the IMF. To be sure, higher fiscal burdens undermine economic...

by Dan Mitchell | Oct 24, 2017 | Big Government, Blogs, Economics, Government Spending

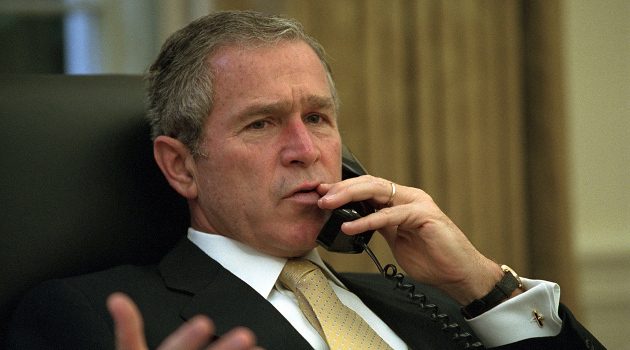

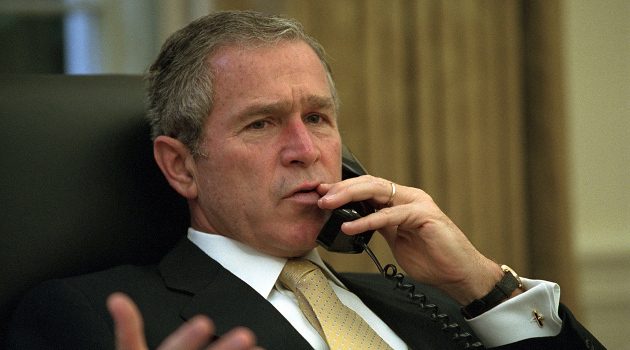

Back in 2013, I did an assessment of economic policy changes that occurred during the Clinton Administration. The bottom line was that the overall burden of government declined by a semi-significant amount. Which presumably helps to explain why the economy enjoyed...

by Dan Mitchell | Oct 9, 2017 | Bailouts, Big Government, Blogs

Puerto Rico is getting lots of attention because Hurricane Maria caused a tremendous amount of economic damage. That leads to an important discussion about the role of government – particularly the federal government – when there is a natural disaster (and a secondary...

by Dan Mitchell | Feb 7, 2017 | Big Government, Blogs, Government Spending, Taxation

I’ve put forth lots of arguments against tax increases, mostly focusing on why higher tax rates will depress growth and encourage more government spending. Today, let’s look at a practical, real-world example. I wrote a column for The Hill looking at why Greece...

by Dan Mitchell | May 25, 2016 | Big Government, Blogs, Government Spending

I wrote last year about why Puerto Rico got into fiscal trouble. Like Greece and so many other governments, it did the opposite of Mitchell’s Golden Rule. Instead of a multi-year period of spending restraint, it allowed the budget to expand faster than the private...