Search Results for : Rahn

No More Subsidies to the OECD from American Taxpayers

I realize it’s a bold assertion, but the $100 million that American taxpayers send to Paris every year to subsidize the Organization for Economic Cooperation and Development is – on a per-dollar basis – the most destructively wasteful part in the federal budget. This video will give you some evidence. But the video also is […]

read more...Why Western Europe Became Rich in the Past…and How It Can Regain Prosperity Today

I’m in Vilnius, Lithuania, where I just finished speaking to a regional conference of the European Students for Liberty. I subjected the kids to more than 90 minutes of pontificating and 73 PowerPoint slides, but I could have saved them a lot of time if I simply showed them this Rahn Curve video and then […]

read more...Three Cheers for Tax Competition

CF&P’s Brian Garst, in an editorial for the Daily Caller yesterday, observes a disturbing trend in the rhetoric of this year’s Presidential campaign. An unholy alliance of political opportunists and long-time opponents of tax competition has formed and is playing on populist economic fears to advance an agenda that threatens to curtail basic economic liberties. […]

read more...Global Taxes Threaten More Than Just the Economy

Writing in today’s Washington Times, Richard Rahn addressed the issue of global taxation. As recently described in a CF&P Libertas, the ongoing efforts of international bureaucrats to impose global taxes threatens not just economic prosperity, but also the very core of self-government. Rahn elaborates: The modern concept of the nation-state goes back to the Treaty […]

read more...The Steroid-Pumped Version of “Taxes Are for the Little People”

I’m not a big fan of international bureaucracies, mostly because they always seem to promote bad policy such as higher tax rates. The International Monetary Fund is urging higher tax rates and pushing for nations to replace flat tax systems with so-called progressive taxation. The Organization for Economic Cooperation and Development has embraced Obama’s class-warfare […]

read more...New Study from U.K. Think Tank Shows How Big Government Undermines Prosperity

It seems I was put on the planet to educate people about the negative economic impact of excessive government. Though I must be doing a bad job because the burden of the public sector keeps rising. But hope springs eternal. To help make the case, I’ve cited research from international bureaucracies such as the Organization […]

read more...New IRS Regulation Shows the “Willful Negligence” of Treasury Secretary Tim Geithner

CF&P’s been fighting for more than 10 years to stop an IRS regulation that would force American banks to put foreign tax law above US tax law. Sadly, we recently lost that battle when Treasury Secretary Tim Geithner finalized the third version of the regulation (it was first proposed by Clinton, and then a second […]

read more...Comparing Obamanomics with Reaganomics, Looking at Evidence from the States

I’ve done a couple of posts comparing Reaganomics and Obamanomics, mostly based on data from the Minneapolis Federal Reserve on employment and economic output. I even did a TV interview on the subject, which generated some comments on my taste in clothing, and also cited a Richard Rahn column that got Paul Krugman and Ezra […]

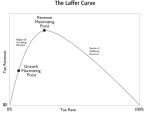

read more...The Laffer Curve Shows that Tax Increases Are a Very Bad Idea – even if They Generate More Tax Revenue

The Laffer Curve is a graphical representation of the relationship between tax rates, tax revenue, and taxable income. It is frequently cited by people who want to explain the common-sense notion that punitive tax rates may not generate much additional revenue if people respond in ways that result in less taxable income. Unfortunately, some people […]

read more...A Case Study of How Government Handouts Undermine Human Decency and Social Capital

Why is big government bad for an economy? The easy answer is that big government usually means high tax rates, and this penalizes work, saving, investment, and entrepreneurship. And perhaps some of the spending is financed by borrowing, and this diverts money from private investment. That’s a correct answer, but it’s only part of the […]

read more...