Search Results for : Rahn

Goldilocks, Canada, and the Size of Government

I feel a bit like Goldilocks. No, this is not a confession about cross-dressing or being transsexual. I’m the boring kind of libertarian. Instead, I have a run-of-the-mill analogy. Think about when you were a kid and your parents told you the story of Goldilocks and the Three Bears. You may remember that she entered […]

read more...Everything You Ever Needed to Know about the Left’s View of Income Inequality, Captured in a Single Image

If you want to know why the left is wrong about income inequality, you need to watch this Margaret Thatcher video. In just a few minutes, the “Iron Lady” explains how some – perhaps most – statists would be willing to reduce income for the poor if they could impose even greater damage on the rich. […]

read more...More Academic Evidence that Bigger Government Means Less Prosperity

My goal in life is very simple. I want to promote freedom and prosperity by limiting the size and scope of government. That seems like a foolish and impossible mission, perhaps best suited for Don Quixote. After all, what hope is there of overcoming the politicians, interest groups, bureaucrats, and lobbyists who benefit from bigger […]

read more...New European Central Bank Study Finds that Government Spending Undermines Growth

The fiscal policy debate often drives me crazy because far too many people focus on deficits. The Keynesians argue that deficits are good for growth and this leads them to support more government spending. The “austerity” crowd at places such as the International Monetary Fund, by contrast, argues that deficits are bad for growth and […]

read more...What’s the Right Point on the Laffer Curve?

Back in 2010, I wrote a post entitled “What’s the Ideal Point on the Laffer Curve?“ Except I didn’t answer my own question. I simply pointed out that revenue maximization was not the ideal outcome. I explained that policy makers instead should seek to maximize prosperity, and that this implied a much lower tax rate. […]

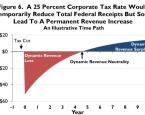

read more...If Obama Wants More Tax Revenue, He Should Lower the Corporate Tax Rate

Regular readers know that I’m a big advocate of the Laffer Curve, which is the common-sense notion that higher tax rates will cause people to change their behavior in ways that reduce taxable income. But that doesn’t mean “all tax cuts pay for themselves.” Yes, that happened when Reagan lowered tax rates on the “rich” […]

read more...New Evidence Shows States with No Income Tax Grow Faster and Create More Jobs

One of the key ways of controlling state and local tax burdens, according to this map from the Tax Foundation, is to not have an income tax. But that’s not too surprising. States have just a couple of ways of generating significant tax revenue, so it stands to reason that states without an income tax […]

read more...We Should Worry about the Long-Run Burden of Government, not the Fiscal Cliff

I appeared on CNBC yesterday to talk about the “fiscal cliff” and the potential impact on economic performance. You won’t be surprised to learn that I’m mostly concerned with how the issue gets resolved. Yes, there is some temporary uncertainty that is probably making markets skittish, but I’m much more worried about Obama bullying the […]

read more...OECD Presses Big Government Agenda

The Organization for Economic Cooperation and Development (OECD) is heavily subsidized by US taxpayers, but spends a lot of time pushing an agenda against taxpayer interests. Richard Billies recently did a good job recounting the OECD’s ongoing list of big government initiatives: …The organization is fundamentally a pro-big government bureaucracy that promotes all of the social welfare […]

read more...A Test of Seriousness

Despite considerable rhetoric from politicians about cutting spending and reducing the size of government, there’s been little in the way of actual results. At best a few promise for future cuts have been secured, but we know what those are worth. A good measure of the seriousness, or lack thereof, with which Congress approaches cutting […]

read more...