Examine how rising inflation would exacerbate the economic effects of enacting a proposal by the Biden Administration and various legislators to tax long term capital gains at ordinary income tax rates.

The Renewable Fuel Standard and Its Challenges

The Policy Brief reviews the origins of and challenges associated with the Renewable Fuel Standard.

The Economic Effects of Wealth Taxes

Estimating the economic effects of the wealth tax proposed by Senator Warren using a computable general equilibrium model of the U.S. economy

Russia’s Ties to U.S. Environmentalist Groups

This Investigation looks into Russian meddling in U.S. energy policy.

Political and Economic Risks of a Destination-Based Cash Flow Tax

The Policy Brief considers the political and economic outcomes of the border-adjustable corporate tax proposed in the Ryan-Brady blueprint.

Aftermarket Shock: The High Cost of Auto Parts Protectionism

This White Paper looks at the abuse of patent protections to unfairly shield auto manufacturers from competition.

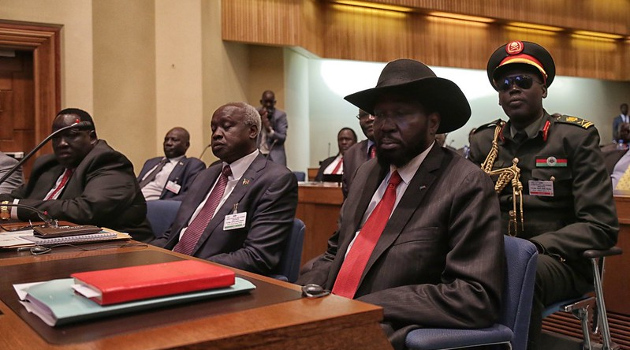

Stumbling Toward Peace in South Sudan

This White Paper critiques the ongoing peace process in South Sudan.

Making Sense of BEPS: The Latest OECD Assault on Tax Competition

This White Paper finds BEPS a continuation of the OECD’s war on tax competition, and a threat to taxpayer privacy and the global economy.