Given the dismal track record of other international bureaucracies, as well as the systemic failure of foreign aid to produce better economic performance, it’s unclear whether any reforms could salvage the EBRD.

Russia’s Ties to U.S. Environmentalist Groups

This Investigation looks into Russian meddling in U.S. energy policy.

Political and Economic Risks of a Destination-Based Cash Flow Tax

The Policy Brief considers the political and economic outcomes of the border-adjustable corporate tax proposed in the Ryan-Brady blueprint.

Aftermarket Shock: The High Cost of Auto Parts Protectionism

This White Paper looks at the abuse of patent protections to unfairly shield auto manufacturers from competition.

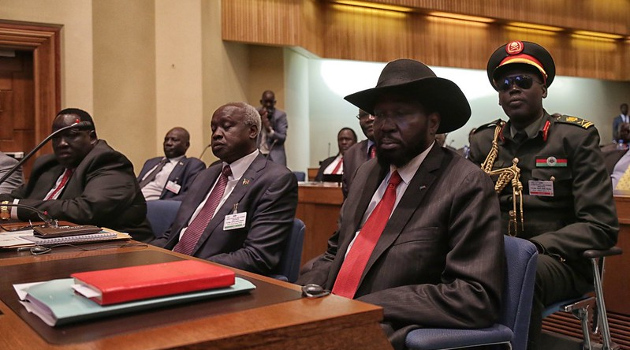

Stumbling Toward Peace in South Sudan

This White Paper critiques the ongoing peace process in South Sudan.

Making Sense of BEPS: The Latest OECD Assault on Tax Competition

This White Paper finds BEPS a continuation of the OECD’s war on tax competition, and a threat to taxpayer privacy and the global economy.

The International Criminal Court: A Case of Politics Over Substance

This White Paper argues that the ICC is fatally flawed in both theory and execution.

The Radical Agenda of Anti-Tax Competition Forces

Opponents of tax competition have long argued that the need to combat tax evasion justified aggressive and counter-productive policies designed to eviscerate tax competition, financial privacy, and fiscal sovereignty.