Sound tax policy is hard to find these days. As CF&P has extensively covered, Congress included the Foreign Account Tax Compliance Act as part of the HIRE Act, passed in March 2010. FATCA takes a fundamentally wrong-headed approach to tax policy. Rather than…

Daily Analysis

FATCA Law is an International Version of Obamacare’s 1099 Provision, a Nightmare for Cross-Border Economic Activity that Is Undermining Investment in America

One of the tax increases buried in Obamacare was an onerous and intrusive “1099″ scheme that would have required businesses to collect tax identification numbers for just about any vendor and then send paperwork to the IRS whenever they did more than $600 of business….

National Economic Suicide to Drive Out Capital

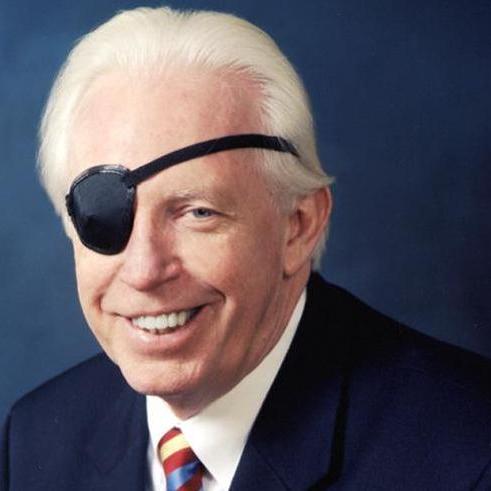

Richard Rahn writes in the Washington Times today on a pair of regulations which he describes as “national economic suicide.” At issue is the IRS’s proposed regulation that would require U.S. banks to report information on foreign account holders,…

When is Enough, Enough?

For the more than a decade the Internal Revenue Service has been chasing after potential U.S. tax evaders by forcing foreign jurisdictions and banks to become deputy tax collectors. From the Know-Your-Customer regulations to the Qualified Intermediary regime, non-U.S….

Coalition for Tax Competition Responds to the FATCA Mess

Congress wants to reduce tax evasion, but politicians are unwilling to address the underlying problem of low tax rates, so they continuously give the IRS more power and make it more difficult for law-abiding people to engage in commerce. A good example is the FATCA…