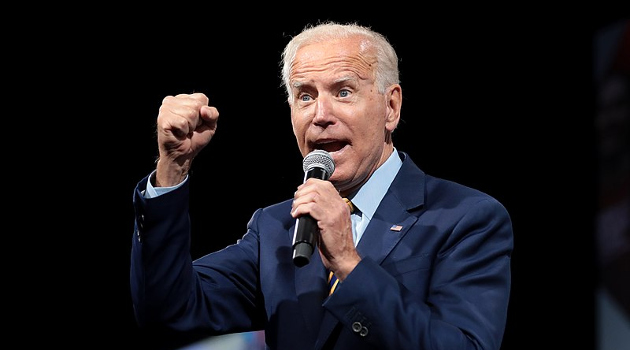

by Dan Mitchell | Mar 10, 2023 | Big Government, Blogs, Featured, Government Spending, Taxation

President Biden has released his 2024 budget, which mostly recycles the tax-and-spend proposals that he failed to achieve as part of his original “Build Back Better” plan. It is not easy figuring out his worst policy. Is it one of the proposed tax...

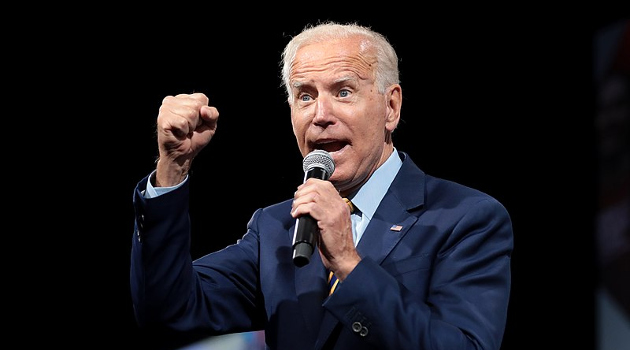

by Dan Mitchell | Mar 4, 2023 | Big Government, Blogs, Featured, Taxation, Welfare and Entitlements

My Fifteenth Theorem of Government points out there is an “unavoidable choice” between entitlement reform and tax policy. Simply stated, the folks who oppose fixing entitlements – including so-called national conservatives and politicians such...

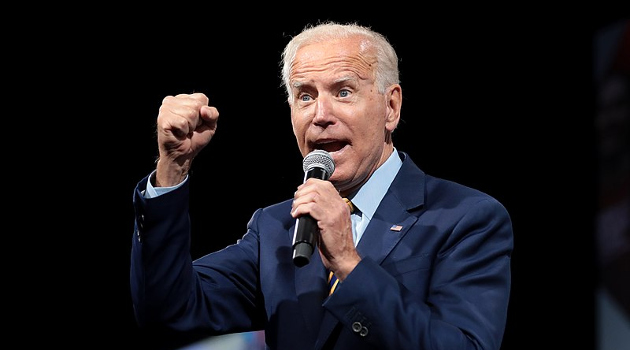

by Dan Mitchell | Feb 26, 2023 | Big Government, Blogs, Featured, Government Spending

In this segment from a December interview, I explain that budget deficits are most likely to produce inflation in countries with untrustworthy governments.* The simple message is that budget deficits are not necessarily inflationary. It depends how budget deficits are...

by Dan Mitchell | Jan 8, 2023 | Blogs, Featured, Tax Competition, Taxation

I’m a big fan of tax competition. Why? Because politicians are far more likely to keep tax rates low when they are afraid that jobs and investment can move to countries (or states) with better tax system. It also explains why tax rates...

by Brian Garst | Jan 7, 2023 | Blogs, Featured, Financial Privacy

The New York State Department of Financial Services recently announced a $100 million settlement with cryptocurrency exchange Coinbase. The story is largely being reported in the context of the collapse of another centralized exchange, FTX. But the implication that...

by Dan Mitchell | Dec 3, 2022 | Blogs, Economics, Europe, Featured

I frequently call attention to my “anti-convergence club” because it shows – using decades of data – that you get more prosperity in nations with more economic liberty. And that’s true everyplace in the world. Including in Eastern Europe, as we can see from...