We shouldn’t encourage other countries to raise taxes on American business

Daily Analysis

Lessons from Monaco on the Benefits of Zero Income Tax

The keys to prosperity are on display in Monaco.

Rand Paul’s Heroic and Vital Fight Against a Global Scheme to Destroy Financial Privacy

Preventing a bad OECD trearty from sneaking through the Senate.

The Necessary and Valuable Economic Role of Tax Havens

Contrary to pro-tax critics, there is a very strong “economic justification” for tax havens and tax competition.

Taxing Lessons from Europe for Hillary Clinton (a Supposed Fiscal Conservative)

Hillary…the fiscal conservative?

The “Race to the Bottom” and Global Minimum Corporate Taxes

Why does Obama want to encourage bad tax policy in other nations?

Democracy, Societal Collapse, Public Choice, Goldfish, and Tax Competition

There are ways to compensate for the natural tendency of ever-expanding government.

Tax Havens Promote Economic Prosperity and Protect Human Liberty

The world is a better place thanks to tax havens.

A False Tax Trilemma

If nations have high taxes, they can’t also have simple tax systems that are appealing to companies and investors.

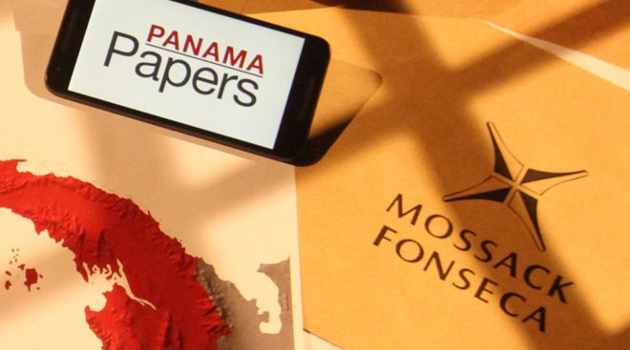

Panama Papers, Tax Planning, and Political Corruption

Focus on the corruption. International investors using international structures should be a non-story.