Four guiding principles for the elimination of tax loopholes and the creation of a neutral tax system.

Daily Analysis

If You Think Corporate Inversions Are Bad, Blame Politicians rather than Pfizer

Here we go again.

The Value-Added Tax: A Nixonian Scheme to Fund Bigger Government

If politicians ever manage to impose a value-added tax on the United States, the statists will have won a giant victory.

The State With the Best Tax Policy Is Actually South Dakota

A couple other states might be receiving some undeserved praise.

Elizabeth Warren’s Anti-Empirical Approach to Corporate Taxation

Elizabeth Warren just said something absurd about corporate taxes.

Israel, the Laffer Curve, and Market-Based Reform

A strong Laffer Curve response to tax cuts in Israel.

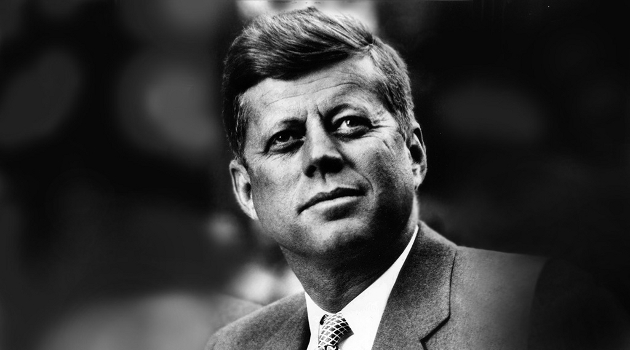

Regarding Eisenhower’s Tax Rates, We Should Listen to JFK Rather than Bernie Sanders

Democrats didn’t used to be so infatuated with punitive tax rates.

Two Small-Government Candidates Inadvertently Could Put America in a VAT of Trouble

A troubling inclusion in otherwise good tax plans.

The Kansas Tax Cuts Are Working, and That’s Why Statists Are Worried

More evidence that low-tax states outperform high-tax states.

Debunking Fiscal Myths: There Is No Loophole for “Carried Interest”

If you’ve been following the presidential campaign, you’ll be aware that there’s a controversy over something called “carried interest.”