I’ve been very critical of Obama’s class-warfare ideology because it leads to bad fiscal policy. But perhaps it is time to give some attention to other arguments against high tax rates. Robert Samuelson, a columnist for the Washington Post, has a very important…

Daily Analysis

Learning from the European Experience: Do Higher Tax Burdens Lead to Less Red Ink?

I’ve been arguing against higher taxes because of my concerns that more revenue will simply lead to a bigger burden of government spending. Yes, I realize it is theoretically possible that a tax hike could be part of a political deal that produces a good outcome, such…

Hong Kong Stands Up to FATCA Menace

The chief executive of Hong Kong’s Securities and Futures Commission is warning against allowing US and European fiscal imperialism in Asia. The boss of Hong Kong’s financial watchdog has called for the authorities to take a greater role in global regulatory…

Don’t Get Bamboozled by the Fiscal Cliff: Five Policy Reasons and Five Political Reasons Why Republicans Should Keep their No-Tax-Hike Promises

The politicians claim that they are negotiating about how best to reduce the deficit. That irks me because our fiscal problem is excessive government spending. Red ink is merely a symptom of that underlying problem. But that’s a rhetorical gripe. My bigger concern is…

Will Obama Learn from England’s Laffer Curve Mistake?

Obama’s main goal in the fiscal cliff negotiations is to impose a class-warfare tax hike. He presumably thinks this will give the government more money to spend, but recent evidence from the United Kingdom suggests that he won’t get nearly as much money as he thinks….

White House Agrees with Me, Admits Tax Revenues Will Climb above Long-Run Average Even if All Tax Cuts Are Made Permanent

Earlier this year, I explained that tax revenues would soon climb above their long-run average of 18 percent of GDP, even if the 2001 and 2003 tax cuts were made permanent. In other words, the nation’s fiscal challenge is entirely the result of a rising burden of…

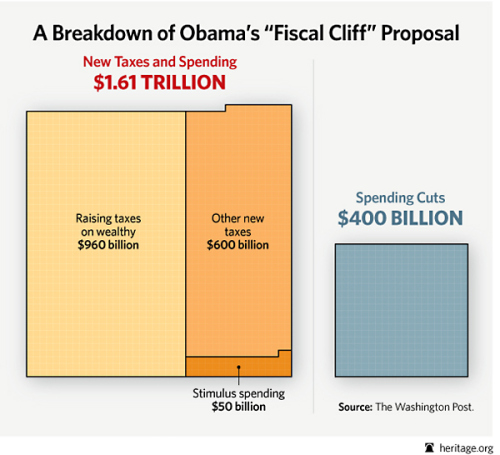

Obama’s Fiscal Plan: Real Tax Hikes and Fake Spending Cuts

If done well, an image can say a thousand words. The Heritage Foundation shows us what Obama has in mind when he talks about a “balanced” plan. This chart, while horrifying and visually powerful, actually understates the case against Obama. The President is not…

Why Are Republicans Willing to Help Obama Make America More Like Europe When the Welfare State Is Collapsing?

Washington frustrates me. The entire town is based on legalized corruption as an unworthy elite figure out new ways of accumulating unearned wealth by skimming money from the nation’s producers. But one thing that especially irks me is the way people focus on the…

A Laffer Curve Warning about the Economy and Tax Revenue for President Obama and other Class Warriors

Being a thoughtful and kind person, I offered some advice last year to Barack Obama. I cited some powerful IRS data from the 1980s to demonstrate that there is not a simplistic linear relationship between tax rates and tax revenue. In other words, just as a restaurant…

The No-Tax-Hike Pledge Is an IQ Test for Republicans

Eugene Robinson is one of the group-think columnists at the Washington Post. Like E.J. Dionne, he is an utterly predictable proponent of big government. So it won’t surprise you to know that he wants taxes to go up and he’s a big fan of Obama’s class-warfare agenda….